I saw this week an interesting post on X by Eric Jorgenson, highlighting the prescience of Naval nearly a decade ago. The tweet he quoted said:

Drones are the new nukes. US drone superiority could usher in a "Pax Dronica" for a decade before tech proliferates & all hell breaks loose.

In one sense, Naval was right — nuclear weapons are terrifying. They are so scary that nuclear non-proliferation is a massive issue that much of the world has acknowledged and united around. Nuclear weapons have become taboo. This is remarkable because are very, very few true taboos in international politics.

In another sense, Naval was wrong. Yes, drones are terrifying. But drone non-proliferation is a massive issue that much of the world has acknowledged…and successfully not done much about.

To be clear, this is not me retrojecting the Ukraine War, Houthi conflict, and Israeli-Iranian proxy and direct conflicts onto Naval’s perspective. When he tweeted that in July 2016, drones were quite active in fighting the Global War on Terror.

Naval’s prediction was spot-on in that we’re now seeing massive drone proliferation in countries that are both friendly and hostile to the US.

Much of this is R&D aims to improve advanced drone technology.

And a very healthy amount of it is happening in startups.

Approaching Consensus

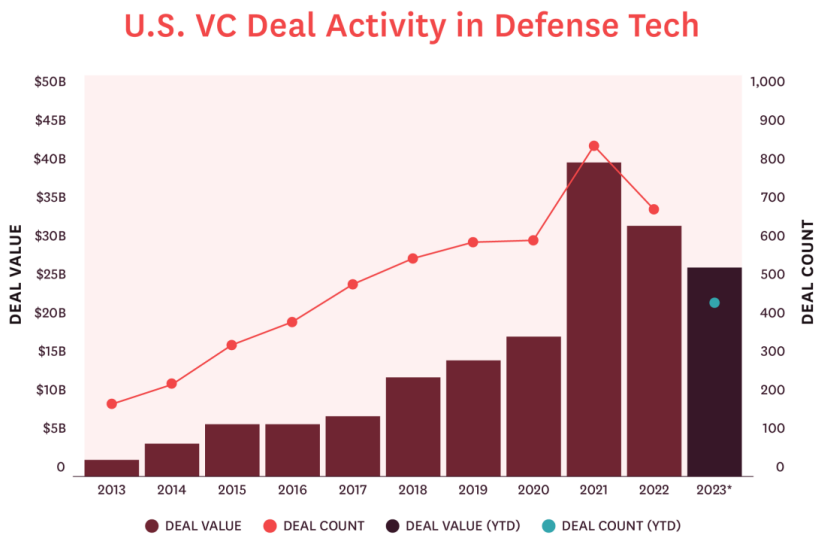

American VCs developing an interest in defense technologies is a long-term trend.

The plot above shows dollars invested in defense tech increased about 10x, and the number of investments increased more than 2x, from 2013 through 2022.

Charting the detailed history of the sector as a VC domain is out of scope for this post, but there are three institutions worth highlighting because they show the maturation of the space into something clearly compelling to VCs:

Palantir is a formerly VC-backed company that is probably the most famous SaaS platform play in the dual-use space.

Founded in 2003

First institutional VC round in 2004

Raised 19 institutional VC rounds according to PitchBook

IPO in 2020

Market capitalization (Yahoo Finance as of 5 June) $311.6 billion

This company is the most successful defense-focused SaaS investment from a VC perspective, in the sense that it’s had a good exit and continues to operate as a successful public company.

Anduril is a VC-backed American defense tech company that focuses on the role of autonomy in its hardware.

Founded in 2017

First institutional VC round in 2017

Most recent valuation of $30.5 billion comes from a round that was announced earlier this week.

This company is significant because it’s the biggest VC-backed, pure play defense investment. It’s still privately held, but it proves unequivocally that defense as a sector within VC can lead to decacorn outcomes in the post-ZIRP era.

a16z’s American Dynamism Fund I

$600 million in committed capital

Target sectors are all government-related, and include aerospace, defense, transportation, public safety, supply chain, industrials, and manufacturing — among others.

2024 vintage, so it’s too early for results to be meaningful

Andreessen Horowitz raising a specialized fund in the space suggests very strongly that defense has become a consensus sector within VC.

Now, talking about financial trends is interesting, but success requires shipping real products. Companies like Anduril are stepping up to the plate, and competing to become prime contractors in DoD programs, such as the United States Air Force’s Collaborative Combat Aircraft (CCA) program.

Looking Forward

The Administration wants to see the DoD top line budget increase 13% during the upcoming fiscal year. But based on what they’re asking for, it doesn’t seem like defense tech startups are likely to be major beneficiaries of this budget boost. It’s also not clear that Congress will actually give the Administration what it’s asking for in terms of a budget.

I expect the real value of the defense budget available to startups to be flat or slightly decline this year as a result of inflation and tariffs. To be clear, this is not a partisan statement of endorsement, rather it’s an analysis of how I expect policy to develop.

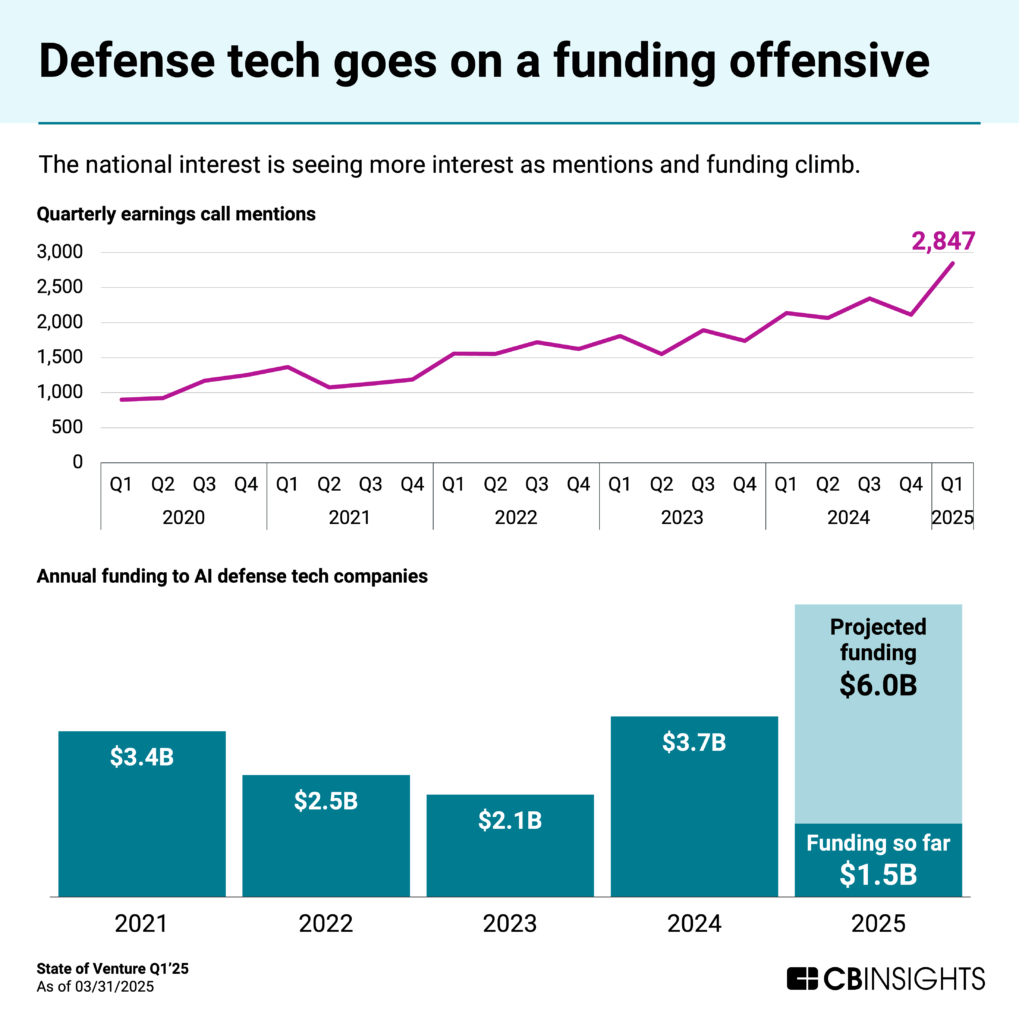

However, that doesn’t seem to be deterring founders. This makes sense on some level, as founders are characteristically optimistic. Anecdotally, I am seeing new startups in the space every month, and there’s plentiful funding for them — especially where there’s synergies with other VC trends, like AI.

In terms of dollars invested, defense tech has recovered from the 2023 downturn. However, it’s less clear whether what we’re seeing is a lot of early-stage rounds, or a smaller number of large investments in later-stage companies.

While it’s a great environment to receive private funding in defense tech right now, I think the public funding situation will make defense tech investing quite difficult over the next 10-20 years.

There are two reasons for this.

First, there’s a real risk throughout the sector that somebody with a better sales motion will just announce a similar product and outcompete startups on contracts of consequence. That might look like a prime contractor such as Lockheed Martin or Boeing.

The way I think this is more likely to manifest is a well-capitalized (perhaps formerly) VC-backed platform play will announce a similar product. I’ve already seen this happen to startups I was engaging with.

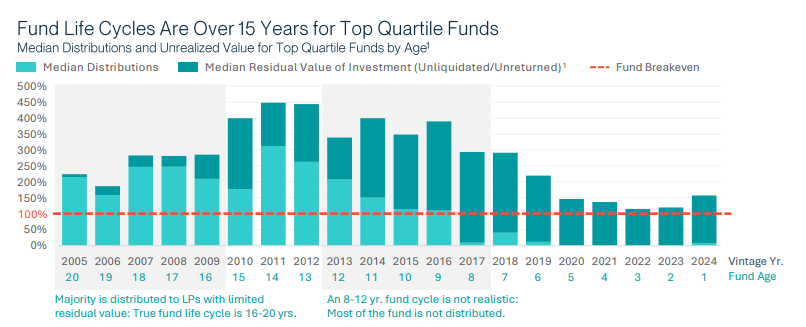

Second, I think investors have to believe the defense tech market is going to change radically enough to generate a VC-scale exit for their investment within the 15-20 year horizon that defines the best funds. If the market size is more or less fixed, startups will have to either outcompete other startups, or outcompete incumbents to achieve great outcomes. I think that’ll be quite difficult, so I expect underwriting a market size change, or a second market, will be easier.

The way I see it, investors in new emerging defense tech startups today likely need to believe at least one of two things about their investments’ market size:

The defense market is going to grow rapidly fairly soon, because the market size isn’t actually fixed.

For dual-use products, the commercial market is already quite large, and capable of a VC-scale outcome on its own.

This second point is certainly possible on a startup-by-startup basis, but it’s limited to products with commercial or civilian applications as well as defense applications. Those can be wildly different, so it’s less meaningful to speak about in broad terms than the first point.

If you invest in startups, like my writing, and want to chat about possible career opportunities, don’t hesitate to be in touch. The best way to get ahold of me is via email:

What’s going to change in the next few years that will increase defense spending?

This is the billion dollar question.

I view the answer to it as critical to whether any particular investment in a defense tech startup is a good one.

Whatever the change is in the US market, it needs to happen in the next few years in order to affect returns over the next decade or so, because large equipment purchases (including drones) are often programmed into the budget several years in advance. This is compounded by the institutional inertia in both Congress and DoD.

With respect to the US, there are two things that I hear about with some regularity in traditional media that might make sense to underwrite defense tech investing to.

The first is possible conflict with China. Some experts in the US defense establishment have adopted a view that China is going to be ready to invade Taiwan as early as 2027, and that such an action might necessitate an American military response. The DoD views China as America’s pacing threat.

The second is possible conflict with Iran. The proximate cause here might be a breakdown over talks regarding the future of the country’s nuclear program — Bloomberg just ran an opinion piece on that today by James Stavridis, a retired Admiral and Managing Director at The Carlyle Group. The other possible cause that I see as likely is conflict stemming from the Israeli-Iranian conflict that’s been happening over the past two years. The US has engaged Iranian weapons during this time, so it is perhaps a more likely scenario.

If either of these conflicts actually happen (and I certainly hope they don’t) they will be fought differently, and rely the most on different types of technology. They justify investing in different kinds of defense tech.

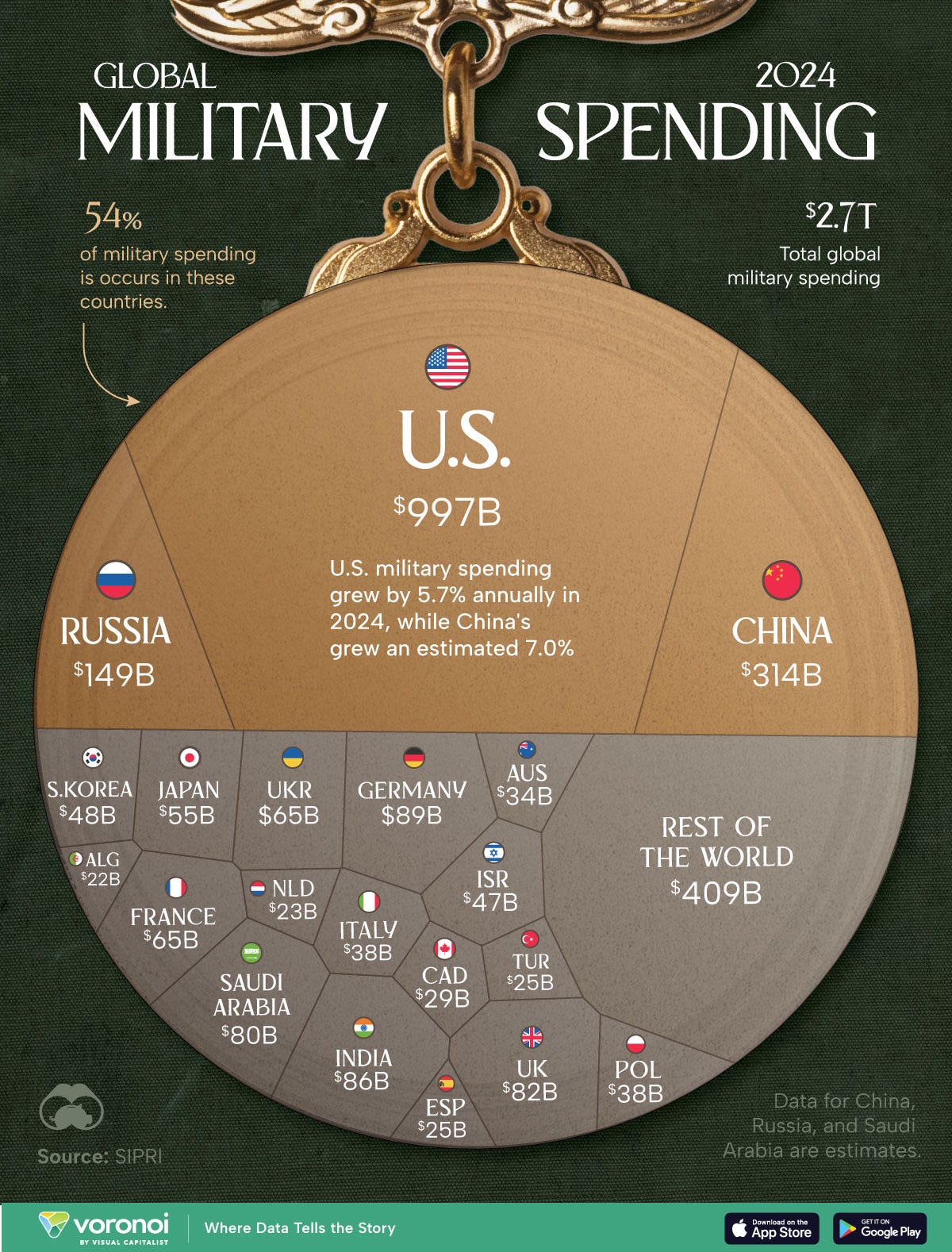

In other countries, I’m not sure what I think investors ought to be underwriting to, but the size of the defense budget (and therefore the amount of the budget that might go to startups) is in all cases significantly smaller than in the US.

Now, in no sense do I mean to condemn dual use tech as uninvestable — it’s quite clearly not. But in addition to “Why will this startup be a winner?”, I think it’s important for investors to have a well-developed perspective on “Why the space is worth winning?”.

That can be challenging in markets with only a few outsized buyers who are not, strictly speaking, spending based on a market-driven rationale.

In sectors that sell almost exclusively to governments, “geopolitics” is a perfectly fine answer to the question.

But it darn well ought to be an explicit and detailed answer — not a wink and a nod.

Air Space Intelligence, which I profiled in April, does an excellent job expressing this on its website.

I liked your breakdown of the VC calculations. Once defense becomes a more crowded space for investors, do you think we’ll see a sharp divide between winners and everyone else? Or does the dual-use potential help more of these startups survive?