Air Space Intelligence: A startup snapshot

A tool to help logisticians anticipate what comes next

When I was in high school, I played water polo. Because water polo is played while swimming or treading water, athletes don’t move as fast as they do in land sports like basketball. One of the coaches would constantly tell us “anticipate to participate”, reminding us that we had to figure out where the ball was going to get to a relevant spot in the pool in time. I was never great at following the instruction in that context, but the theory stuck with me.

In this week’s startup snapshot, I’m looking at Air Space Intelligence (ASI). ASI is a dual-use startup that’s trying to help its customers “anticipate to participate” in aviation, logistics, and defense activities.

Problem

Historically, decision-makers functioned primarily by reacting to new information. However, in order to make decisions in complex post-modern environments, key personnel need to stay ahead of events in order to achieve their institutionally desired outcomes.

Solution

ASI builds software that enables people to anticipate events, not just participate in them.

ASI offers solutions to the following types of customers:

air operations

air traffic management

global logistics

defense

The CliffsNotes of the company’s long-form thesis is that logistics has been key to historical American successes in international relations, and this will be true in the future as well. Logistics is therefore key to American national security, and requires a whole-of-society approach that integrates both elements of the domestic industrial base and our foreign allies with US government institutions. ASI is building a dual-use software stack, and the intended commercial customers are in the logistics industry.

ASI also thinks the fundamental question of software is less “What is happening?” and more “What should be done?”, and that this is applicable both at the user level and vendor level. If GPS was the big dual-use innovation of the 1990s, the next-generation dual-use technology is going to be prediction machines, to help operators answer that key question better.

Founders

Phillip Buckendorf, the CEO, is motivated to build startups. His background at Uni Robotics suggests that he's qualified to look at AI-powered products. He's also a second-time founder, which reduces the risk of founders not understanding what they're getting into.

Kris Dorosz, the CTO, has a PhD with expertise in driving systems AI. He's built systems that enable advanced human-machine teaming and decision-making.

Lucas Kukielka, the third cofounder, is a product-obsessed builder with domain expertise in geospatial data.

The founding team has founder-market fit.

At this point, the founders have built up a strong team of senior leaders surrounding them. This still looks like a founder-led company, but it’s no longer just the founders who are critical members of the management team.

Market

Top-down

Commercial

ResearchAndMarkets.com thinks the market size for aviation analytics software was about $1.7 billion in 2020, and expect it will grow to $3 billion by 2025. This suggests a very attractive CAGR of 11.5%. The market concentration in aviation analytics software on the commercial side is significant. There are 61 US airlines, of which 20 do more than $1 billion in annual revenue. These will be the most largest customers in this segment. In the business aviation market, there are about 15,000 aircraft, with far lower user concentration.

Grand View Research says that the global market for air traffic management was worth $8.6 billion in 2023, and is expected to have a more modest, though still attractive, CAGR of 8.6% through 2030. In 2023, hardware represented about 60% of the market, though the software segment of this industry is expected to grow at a faster rate. The biggest airports are the biggest spenders, which makes sense. North America has the plurality of the market, generating 33% of the revenue. The US market is expected to grow at a slightly slower rate — the CAGR here is just 7.8%, compared to 9.8% in the Middle East and Africa, and 10.2% in Asia and the Pacific. MarketsAndMarkets looked at the data in 2022, where it saw a market of $8 billion. It thinks the market will be worth $11.8 billion by 2027, suggesting a CAGR of 8.1%.

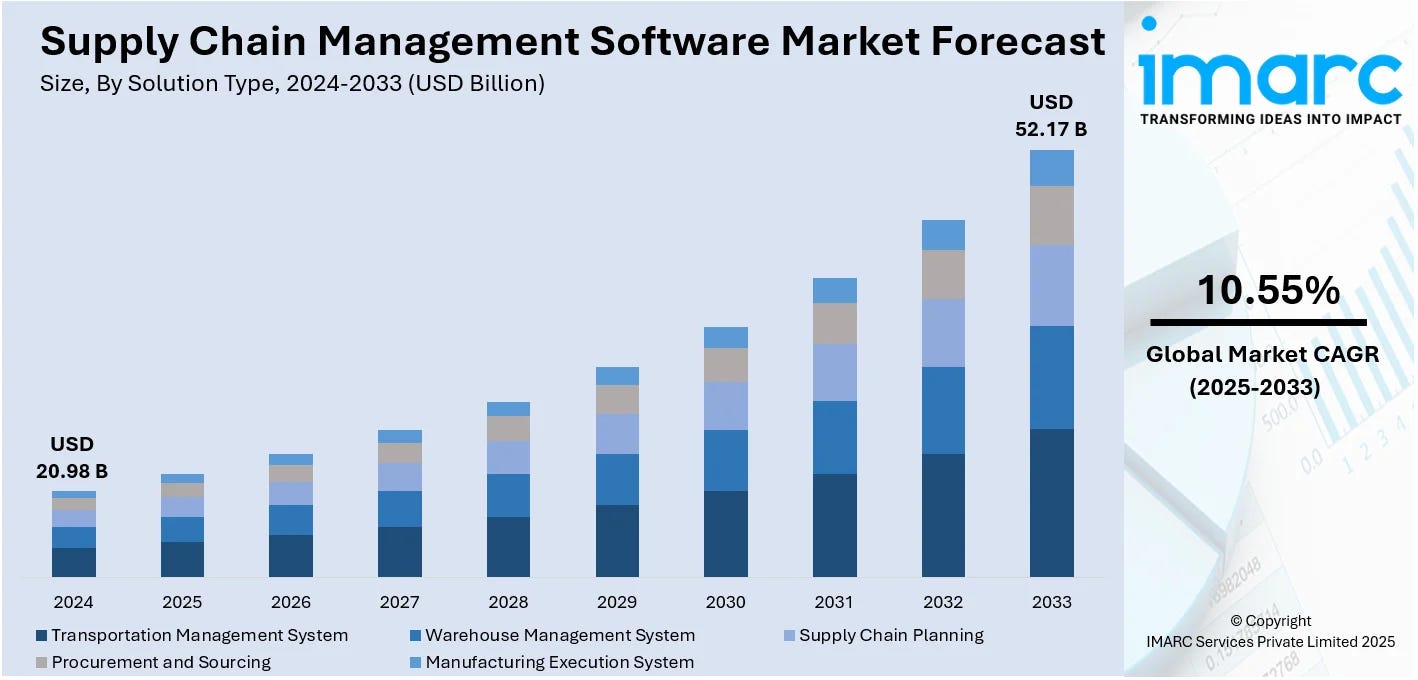

Their global logistics market segment is essentially supply chain monitoring and management software. IMARC Group says that the supply chain management software market size in 2025 is $20.98 billion, and the firm thinks it will grow to $52 billion by 2017, implying a CAGR of 10.5%. The US holds the plurality of the market, controlling 39%.

Government

Defense spending seems likely to follow the DoD’s spending commitment to Critical Technology Areas discussed in the Danti snapshot. However, ASI is expected to benefit more from the Trusted AI and Autonomy and Advanced Computing verticals. Budget Activity 6.3 covers Advanced Technology Development, which I think is about where a startup that’s raised a Series B is in terms of technology maturity. The sum of the Budget Activity 6.3 allocations in these two fields for FY 2025 is $1.68 billion. This won’t be recurring revenue, but is a reasonable first-order estimate of the funds that are potentially available to the startup and its competitors for pilot contracts and adding government-specific features.

Bottom-up

Alaska Airlines’s CFO says on ASI’s website that the tool provided 3-5% fuel savings. Let’s say the expected effect market-wide is only 2.5%, because maybe the reason Alaska Airlines was willing to provide a blurb was ASI’s tool outperformed their expectations. According to Global Market Insights, the US market for aviation fuel in 2024 was $238.2 billion. 2.5% of that, what I think ASI can save, is $5.96 billion. If ASI can capture 10% of the savings there between the amount of the market the firm can realistically penetrate and the revenue it could generate, this represents a $595.5 million market. Using any soft of software multiple on revenue (4x-10x) this alone is a large enough business line to eventually justify a unicorn valuation.

There’s not easily accessible information about either ASI’s pricing, or what sort of value the air traffic management and global logistics customers get from ASI’s products. This makes it hard to come up with a meaningful bottom-up market size here.

The defense market for this tool on an operational basis (as opposed to test and evaluation) can’t be estimated from the bottom up with any confidence, as that would require an understanding of unit-level budgets not just in the US, but in several other NATO countries as well.

In any event, it seems clear that there’s venture scale potential here from the bottom-up as well as top-down. Furthermore, looking at both types of market construction, ASI’s making a platform play into multiple venture-scale markets.

Fundraising History

PitchBook suggests the firm went right to a Series A, without a seed or pre-seed round. In the transaction, the firm sold 48% of the equity, which is far more than average dilution for having raised only a Series A in this window according to Carta. Between the dilution being about twice the norm for a Series A, and the logging of all the investors in the round as new investors, I suspect ASI may have raised earlier rounds of financing, and they were just logged together on PitchBook with the Series A.

The Series A raised $22 million on a pre-money valuation of $79 million in January 2021. It’s not clear who led the round, but institutional VC investors included Bloomberg Beta, Four Cities Capital, Franklin Venture Partners, Gradient Ventures, Niche Capital, Operator Collective, Renegade Partners, Shield Capital, Spark Capital, Village Global, and XYZ Venture Capital. There were a number of Angels as well.

The Series B raised $34 million on a pre-money valuation of $266 million in November 2023. This round had far less dilution. Andreessen Horowitz led the round; other new VC investors included Friends & Family Capital, and a couple non-VC investors. Bloomberg Beta, Renegade Partners, and Spark Capital followed on.

Selected Competition

It’s not clear to me that there’s any one firm that’s going to compete with ASI. However, there’s a number of firms with clear product overlap who have the potential to expand into the places where ASI plans to play.

Anduril builds defense hardware as well as an AI tool that coordinates among its products; it’s probably doing what ASI plans to do — for its products only.

Flightkeys is a SaaS tool that plans flights.

Palantir is a leading provider of AI solutions to a variety of commercial and government customers.

Portside is a flight management system for aviation operations.

Rebellion Defense builds advanced software to help mission-critical institutions stay ahead of emerging threats.

Shield AI provides AI-enabled autonomy to a variety of different systems in aerospace and defense.

Technology

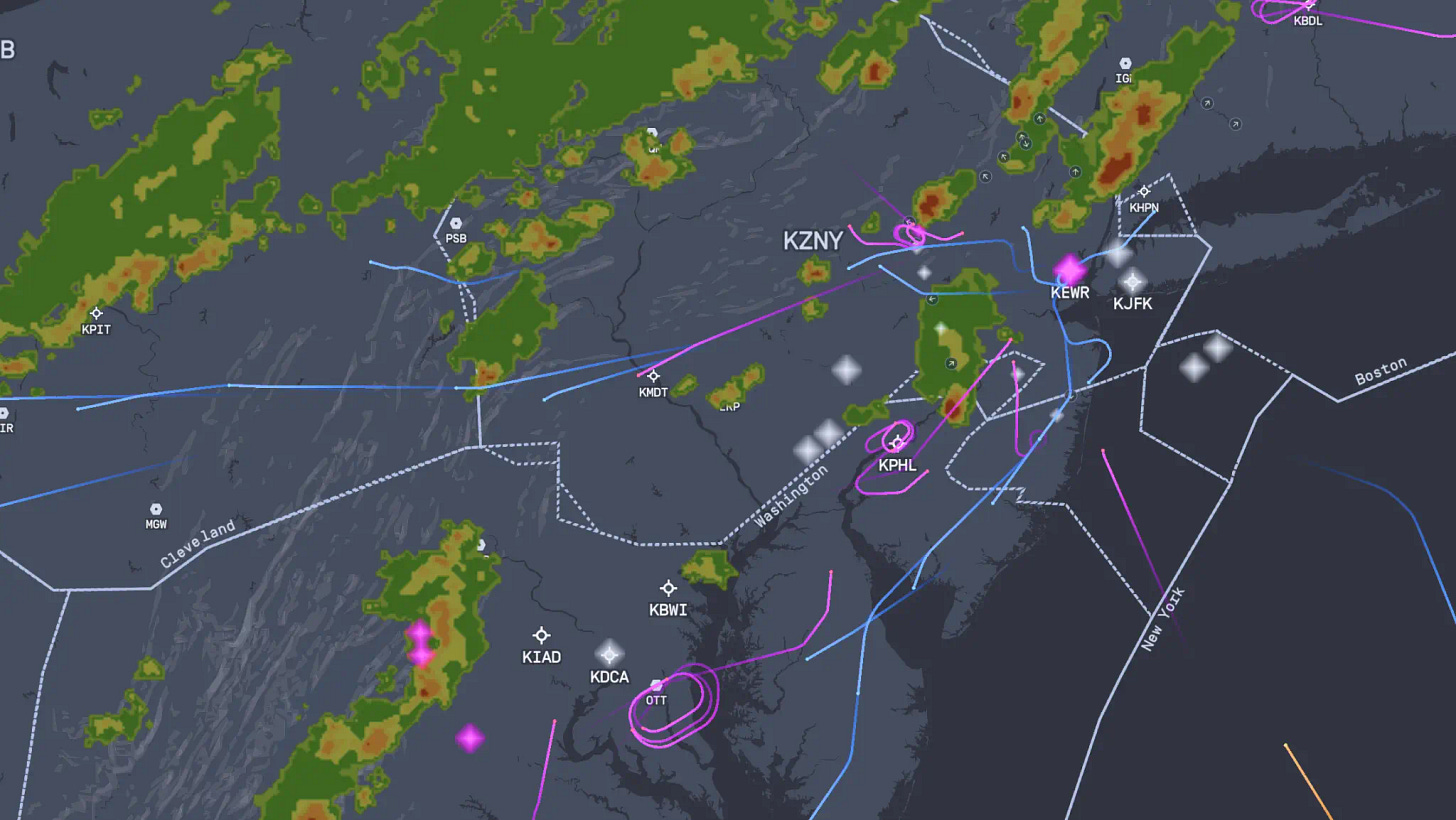

PRESCIENCE is an AI-enabled platform technology that creates a dynamic model of the operating environment in all three dimensions, as well as time. This environment can include sea, air, and land data. ASI calls it a “digital twin”, though I’m not yet convinced that term is used by the company in the way that I see hardware engineering firms use it. In any event, PRESCIENCE lets the company optimize high-stakes, time-critical workflows — and visualize them to operators. It’s also modular, and extensible, supporting data fusion.

The value propositions of PRESCIENCE include:

data fusion

domain modeling

prediction & simulation

optimization

communication

operational analysis & replay

The video above shows a visualization of the firm’s replay capability, which the firm anticipates being useful in debriefing event participants.

Progress

As a Series B startup, it seems like ASI has built its initial products and is expanding its go-to-market (GTM) motion across the four key customer lines.

The quote from the Alaska Airlines CFO is evidence that that product may have found Product-Market Fit (PMF). Seeing such a large savings in such a large institution — along with enthusiastic executive endorsement — is not a small thing.

Similarly, the case study about flight optimization suggests the air traffic management offering may also have found PMF.

The firm is a bit quieter about the current state of global logistics and defense offerings.

Assumptions

In order to seriously consider this startup as a potential investment candidate, I’d need to be comfortable with these key assumptions:

The firm is deploying code today as quickly as it aspires to.

As the firm grows, the velocity of development will not decrease much.

The commercial-first sales motion is the right one for this sort of product.

The firm can get to positive unit economics on an AI tool within a few years.

Key Open Questions

If I had more time, these are the most significant questions I’d dig into.

How much will ASI’s success rely on sales abroad?

How much will ASI’s success rely on sales to US government agencies?

How does ASI plan to vary its GTM approach in the long term based on geography and sector?

Final Thoughts

The firm’s thesis is quite clear about its intention to iterate rapidly and get inside the competition’s OODA Loop. This is applied in the text to the company’s discussion of an impending conflict with China. But it’s not any less applicable to the firm itself. The authors say:

Reacting in real time isn’t just slow—it’s losing by design. Victory belongs to those who predict, adapt, and act before the enemy has even moved. Anticipation is the new high ground.

ASI is doing this in its product development and literally betting the firm on this vision. That’s pretty brave.

If you invest in startups, like my writing, and want to chat about possible career opportunities, don’t hesitate to be in touch. The best way to get ahold of me is via email: