Moonshots that pick the wrong funding mechanism don't launch

Reactions to NASA's Mars Sample Return update

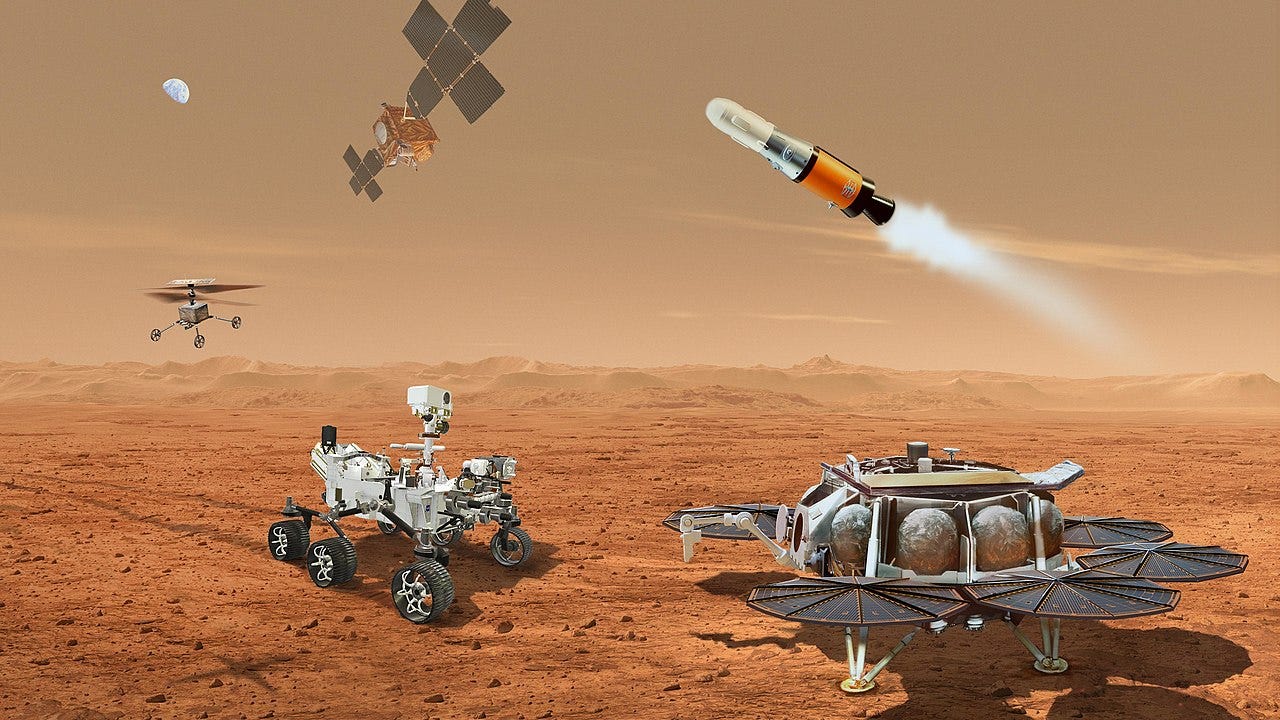

Earlier this week, NASA announced via media teleconference that it’s potentially altering the plan for its Mars Sample Return mission.

The original plan would have cost $11 billion and returned samples in 2040. The critiques were that it was too expensive, too slow, and too complex.

SpaceNews.com reports that the biggest change will be how a redesigned sample retrieval lander will descend to the Martian surface, and that the options being studied include:

a sky crane developed by the Jet Propulsion Laboratory (JPL)

this would cost $6.6-7.7 billion

an artist’s conception of a JPL-built sky crane is shown at the end of the video below (4:11 after the start) delivering the Curiosity rover to Mars; this happened in 2012

JPL built and operated a second sky crane in 2020 during the Perseverance mission

some sort of larger lander, presumably with an engine on the bottom

this would cost $5.8-7.1 billion

this could be sourced from a commercial company

Regardless of which approach NASA takes, JPL now thinks the mission can be done for less than $7.7 billion and 1-5 years early (somewhere between 2035 and 2039).

Shortly after the telecon ended, Rocket Lab updated their website to reflect an interest in competing for the project, more quickly and cheaply than even the NASA teleconference suggested was possible. By making a couple additional architectural changes and replacing the European Space Agency (ESA) Earth Return Orbiter with one of their own design, the firm thinks it can accomplish the mission for no more than $4 billion, and potentially as early as 2031.

Let me start by saying two things.

First, Mars Sample Return is absolutely a moonshot. It’s a multi-decade effort that requires technologies which did not exist at the start of the program in order to accomplish important science. This is exactly the kind of spaceflight the government should be funding.

Second, Mars Sample Return proves out engineering concepts we’re going to need to send humans to Mars, like launching a rocket from the surface of Mars, and landing on Mars with the precision of meters. It’s absolutely worth doing if we’re serious about sending people to Mars.

But it also raises a bunch of non-technical questions that I think are important to understand:

What is the Jet Propulsion Laboratory?

Why did they get this contract?

Why should somebody in the startup world outside the space industry care about this update?

What is the Jet Propulsion Laboratory?

The Jet Propulsion Laboratory is a Federally Funded Research & Development Center (FFRDC) managed by Caltech on behalf of NASA. There are 42 FFRDCs throughout the US working mostly on STEM programs for the federal government.

While today JPL runs most of NASA’s planetary science programs, it got its start in missile R&D efforts for the US military. It’s been contributing to aerospace research for nearly a century.

As part of the planetary science program, JPL leads NASA’s Mars missions. This includes orbiters, landers, and rovers. They are the world’s experts on how to land things on Mars, especially if they weigh about or less than the size of a small car.

The Jet Propulsion Lab is 5 for 5 on Mars rovers that landed and worked — and the only other institution on the scoreboard is the China Aerospace Science and Technology Corporation, which is 1 for 1. This matters because, as Space.com claims, the US and China are in a competition of sorts to bring back Mars surface samples first.

Why did they get this contract?

JPL is an FFRDC. FFRDCs generally exist to enable the government to maintain a unique capability that it considers both essential, and very difficult to preserve in a for-profit market environment. Most FFRDCs support the Department of Defense, Department of Energy, NASA, or some element of the US healthcare system.

Because FFRDCs preserve such specialized knowledge, the federal government tends to awards them contracts to apply that knowledge through non-competitive processes, which is pretty unique (normally the government prefers a competitive process).

JPL’s been interested in a Mars Sample Return mission since the early 2000s. At the time when the current NASA-ESA Mars Sample Return concept was approved, in 2022, nobody else had figured out, or seemed likely to figure out, how to land a large rocket and the sample loading mechanisms on the surface of Mars by the sample retrieval lander’s target launch date of 2028.1

They got the contract because the government thought nobody else could do it.

And in all fairness, no US institution outside JPL has actually accomplished a Mars landing yet.

SpaceX and Blue Origin talk about these sorts of programs on an almost regular cadence. And in 2025, I believe either company could accomplish the mission by 2040.

But from a commercialization perspective, neither of those firms is all that interesting to me. SpaceX regularly raises money and issues tender offers at fantastic valuations, and as far as I can tell, Blue Origin is financed by Jeff Bezos selling Amazon stock. Consequently, I believe that either firm can afford to take a loss on a program like this, and therefore to bid under cost, and is incentivized to do so as the value of being the first to have Mars flight heritage hardware is going to be massive.

Hearing interest from a company like Rocket Lab, with short-term earnings per share targets that investors really care about and the SEC looking over their shoulder to protect retail investors, is far more encouraging to me. This suggests how strongly its management believes it can be done on-budget, on-schedule.

Furthermore it sounds like so much redesign work has happened on the return elements of the architecture like the Sample Retrieval Lander that it’s not truly the same concept that was studied in prior years. It sounds like a real-life Ship of Theseus. This seems to be contributing to the cost and schedule problems that make commercial competition for this portion of the mission interesting. From what I’ve heard on X, it sounds like it’s practically a different design at this point.

The conclusion I draw from it all is that Mars landing is now sufficiently competitive that it’s no longer a good fit for FFRDC financing.

Why should somebody in the startup world outside the space industry care about this update?

NASA seems to be using the development of commercial interest to force JPL to reduce the cost of this mission. In the context of the initial top line cost and all the other things NASA wants to do in the coming decade (new space station, crewed moon landing, other planetary science, aerodynamics research), that’s not totally unreasonable.

American and European citizens should all care about this because the way the government spends our tax dollars is important. We deserve the most bang for our buck, and for whatever reason that wasn’t happening on this program. It still might not be now, but we’re at least $3 billion closer.

What this speaks to more broadly is the importance of pursuing the right funding mechanism for an idea.

NASA thought the technology was so…far out…that the only way to accomplish the mission was through an FFRDC. Now that there’s apparently commercial interest from several commercial operators, it’s not clear that the FFRDC approach is appropriate. The question of suitability for FFRDC funding highlights not just what can be done, but what should be done. This framing is critical for founders.

From a purely economic perspective (assuming clean term sheets), a solo founder bootstrapping to a $100 million exit is identical to taking VC money, selling 90% of the equity to raise capital, and selling the firm for $1 billion. In either case, they have a $100 million exit. But there are often other compelling reasons to either take or avoid money from VCs, and I encourage founders (especially first-time founders) to spend some time thinking about this.

This question about what should be done should be asked by financiers as well, in that not every moonshot is venture backable. There are two key issues that I think scare most VC investors off from deep tech.

The first is the time to financial return. Even though this may not be real, there’s definitely a perception that deep tech investments take longer to return capital. That’s concerning to non-specialized investors, and investors whose performance is tracked by Internal Rate of Return (IRR — a performance metric that accounts for the time value of money). My impression is that the two key drivers of this are the technology’s readiness and the market’s readiness. There are other relevant factors, but if founders are not convinced that both of these are ready to scale in a big way within 5-8 years, it’s particularly challenging to raise funds for a deep tech startup.

The other major potential issue is how much of the value from the moonshot technology actually goes to the startup. My impression is that most doesn’t, and that’s alright — as long as enough does in dollar terms that it satisfies investors, founders, and employees.

Mars exploration is absolutely a moonshot, and absolutely worth society spending money on — but not out of an institutional VC fund.

In 2016 Elon Musk predicted he’d send people to Mars by 2022. It’s now 2025, and I count a human population of 0 on Mars. I’d never bet against his ability to do something, but his schedules are…aggressive, and often require revising, so I can see why NASA might not have taken him super seriously about this.