Investing in Deep Tech Q3 2025

A public equities portfolio update

Since we just ended Q3, it is time for an update on my publicly traded deep tech portfolio.

As a reminder, this is an important topic to cover on a recurring basis because “deep tech” has this perception as totally inaccessible to retail investors…and it isn’t.

Most deep tech firms don’t trade on the public markets, but that’s not unique to emerging technologies; it holds true for much of the US economy.

Retail investors who want to invest in deep tech absolutely can, if they have the risk tolerance for emerging companies trading on the public markets.

To be clear, this doesn’t mean retail investors should invest in public firms in deep tech.

Furthermore, none of what I am about to say is investment advice. It is particularly not investment advice for you, the reader.

Please do not make investment decisions based on the content of this Substack.

Trades

On August 22nd, I sold 7 shares of Rocket Lab to buy 7 shares of AST SpaceMobile. I did this for two reasons.

First, I owned far too much Rocket Lab to be happy with my portfolio construction, even though I continue to think it is the best publicly traded aerospace growth firm. Second, I owned too little AST SpaceMobile. I either needed to get rid of it or make it a more substantial part of my holdings, because it wasn’t worth my time to worry about a stock representing about 2% of a concentrated portfolio.

Rejected Trade Ideas

I thought about making an investment in an aerospace component provider.

Voyager Technologies and Karman Space & Defense were considered and rejected because the firms went public too recently. By this I mean they still have shares from their IPO/SPAC/direct listing that are locked up.

Redwire was considered and rejected because the majority owner is AEI, a Private Equity firm. I’m open to occasionally investing in non-founder-led firms (like Amazon). But I don’t intend to invest alongside a controlling PE fund, because I expect it will have a plan to exit the investment, I expect such a plan will hurt the stock price, and the fund will always know more about that plan than me.

Current Portfolio Composition

I hold the same stocks as I did last quarter— Rocket Lab, AST SpaceMobile, Planet Labs, Amazon, and Oklo.

My rationale for holding them is unchanged.

Between the first four, I cover the markets within the space sector that I see as mature enough for public investment:

Launch Service Providers (Rocket Lab)

Telecommunications Satellites (AST SpaceMobile)

Earth Observation Satellites (Planet Labs)

Ground Stations (Amazon)

Oklo is a reflection of my views on the importance of nuclear fission as an energy source of the future.

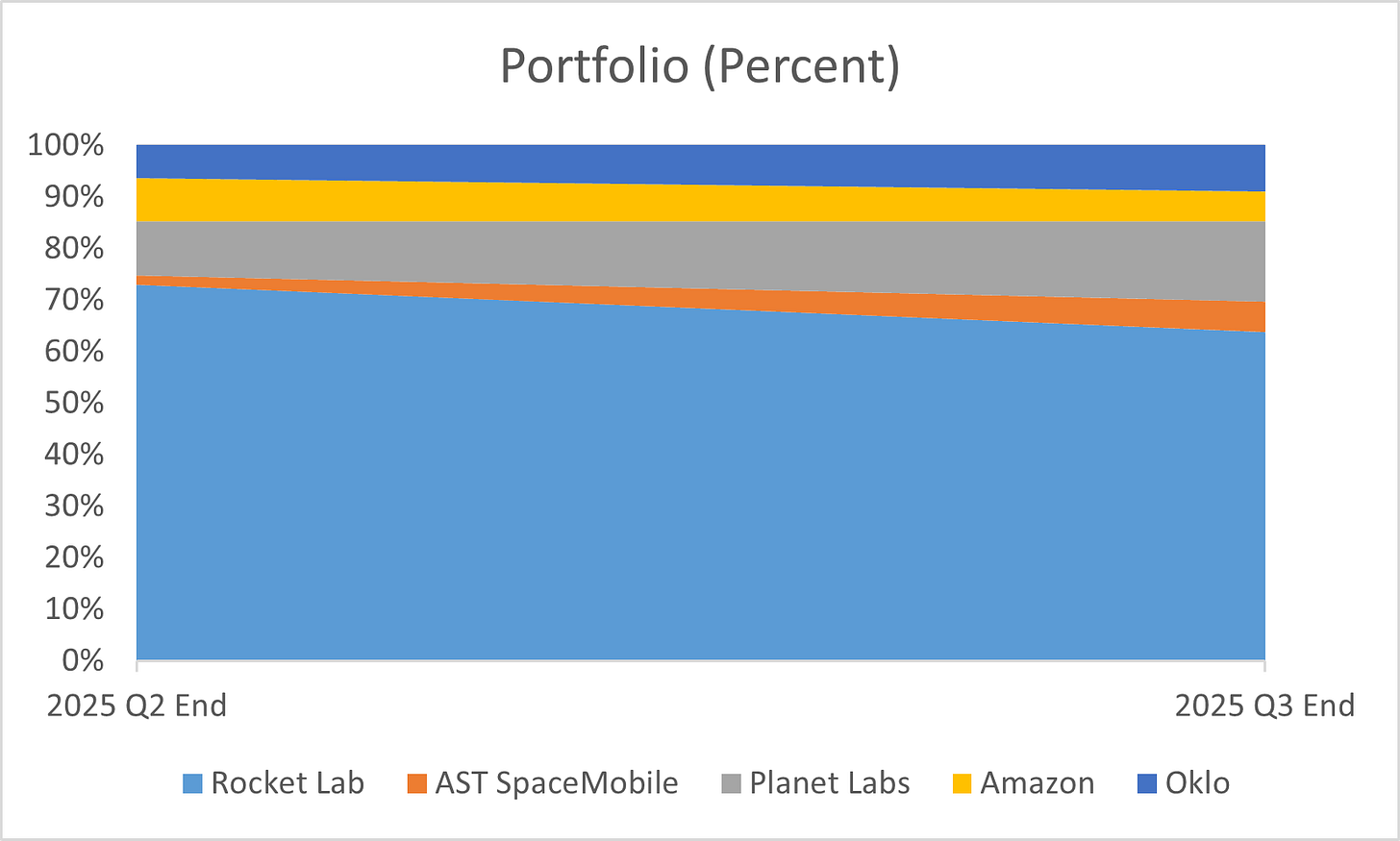

This is my portfolio construction by percentage.

This plot demonstrates two changes over the past quarter.

As a result of my one trade, my smallest holding has switched from AST SpaceMobile, which was 1.8% of my portfolio, to Amazon, which is now 5.8% of my portfolio. I’m happy with this for a few reasons:

Amazon is an outlier in my portfolio in that it’s the only company not run by a founding CEO, and in that it’s a gigantic firm. I’m happy to hold it, but it’s perhaps the least thematically consistent, so I on some level like it being the smallest.

Given that I’m not trying to make an index, I think 5.8% is a more reasonable number for my smallest holding than 1.8%.

I’m still uncomfortably overinvested in Rocket Lab, though that’s largely because the stock has done so well. Furthermore, the percent of the portfolio that it represents has dropped from 73% to 63.8% over the past quarter. As I find attractive investment opportunities, I’ll continue to bring this percentage down.

Benchmarks

For portfolio performance I use VOO, which is Vanguard’s S&P 500 index ETF, because that’s what I’d be investing in if it wasn’t these companies. My yardstick for this portfolio is VOO’s performance.

For individual stock performance I use VBK, which is Vanguard’s small-cap growth ETF, because it contains more companies that are similar to the types of companies I’m interested in (by both size and sector) than VOO. My yardstick for specific stocks is VBK.

With respect to both benchmarks, I do not include dividends because it makes the math more manageable, and because the stocks I’ve invested in don’t issue them.

Performance

Note that performance metrics include both realized and unrealized gains and losses, because at this point I’m reinvesting sale proceeds ASAP.1

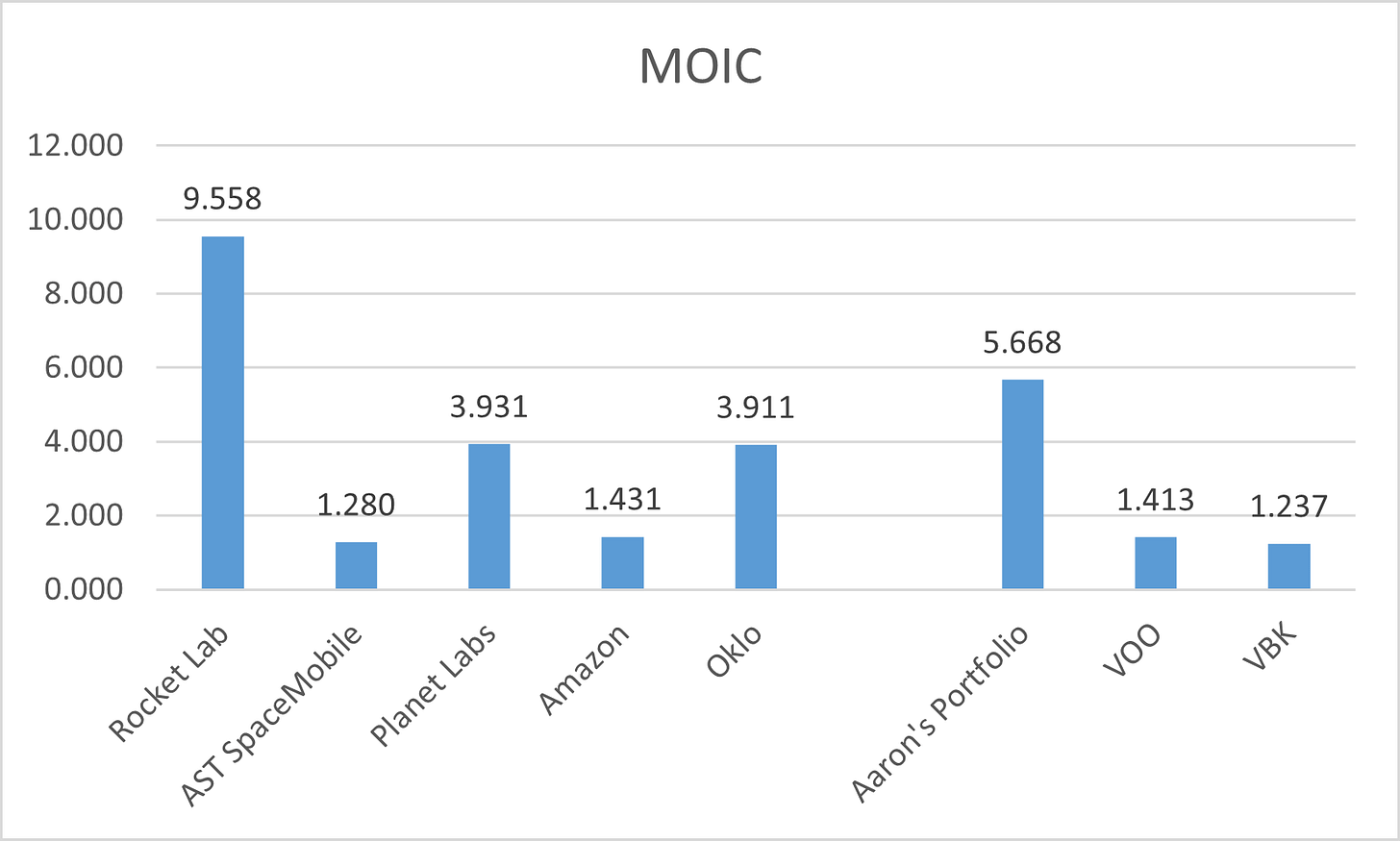

The MOIC analysis isn’t all that interesting; it’s basically showing a very smoothed over stock price chart.

The price of all the stocks in this portfolio has increased over Q3 2025.

Everything is outperforming the MOIC individual stock benchmark; the only holding that isn’t outperforming the portfolio MOIC benchmark is AST SpaceMobile.

Rocket Lab is one of the recent stock market success stories, and as a result I have radically outperformed both MOIC benchmarks.

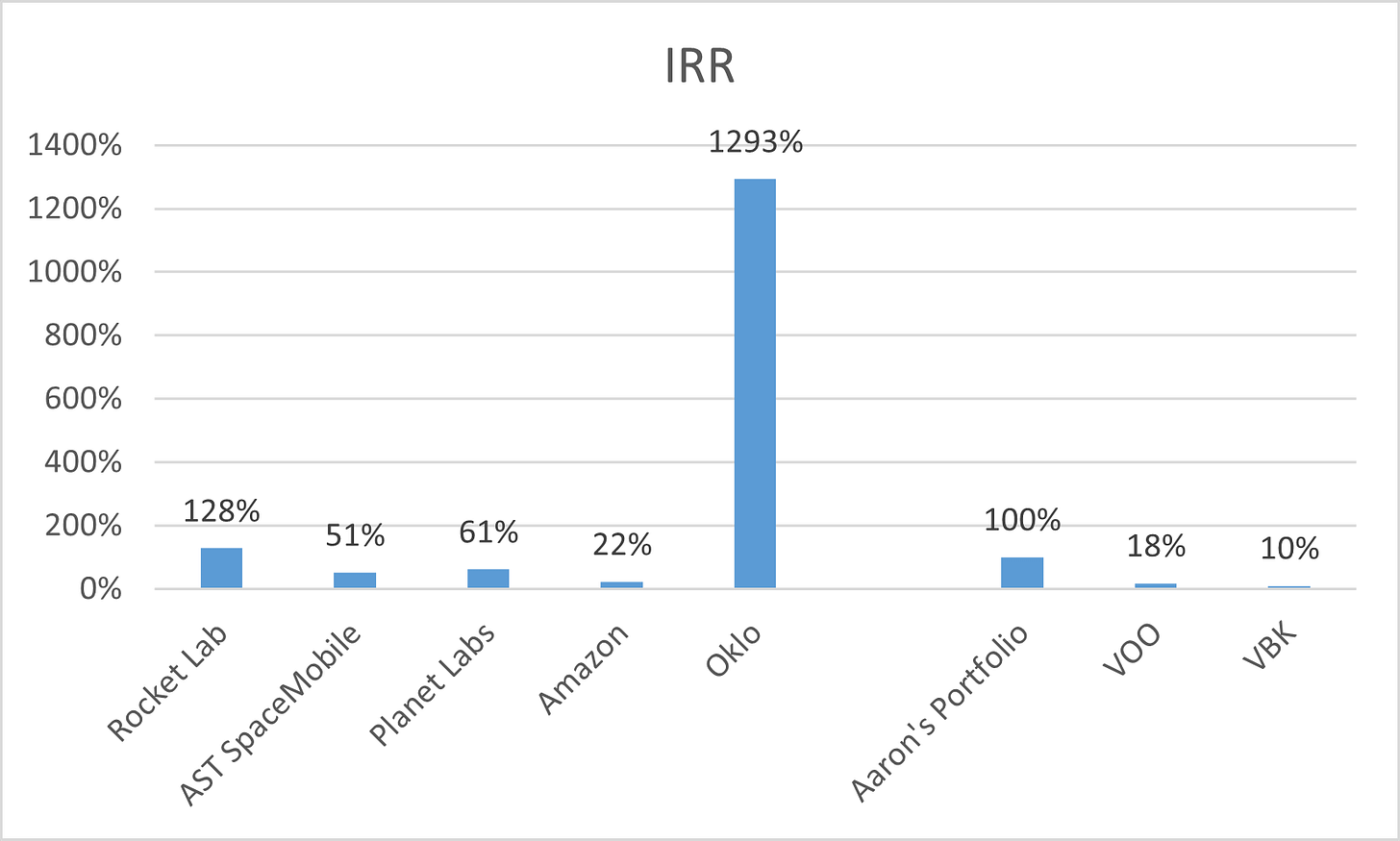

Everything is outperforming the IRR individual stock and portfolio benchmarks.

Oklo’s remarkable performance here is a function of two things that have happened together:

I bought the stock relatively recently, in early 2025 (the oldest purchases in my portfolio date back to 2021, when I was approaching this basically unsystematically)

The stock price jumped aggressively this summer, particularly in September

At the same time, since it’s such a small portion of my portfolio (8.9%), it’s not really moving the needle all that much in terms of overall IRR.

I thought about looking at performance on a quarterly basis and an overall basis, and then decided against it. Sharing quarter-by-quarter performance would matter if I was looking to make investing in the public markets a career, or if I was planning to hold stocks for less than a year…but neither of those are the case. I take what public markets investors consider to be a long-term view. I think that putting together quarter-by-quarter charts would lead to recency bias in how I think about what’s a good investment or not. If you think that’s the wrong move, please let me know in the comments!

When I’ll consider closing out positions

Some people plan to hold their investments forever. That’s how Buffett thought about investing, and that’s how I think about my index fund investments.

But that doesn’t work for my approach to this portfolio, because I have a growth strategy, and growth that outperforms the market is not possible in the very-long-term.

If I can’t decide when to sell and also be right about those decisions, I cannot outperform the market and should just invest more in VOO.

So here’s my view on when I should consider an exit.

Bull Cases

If everything goes well, here’s when I plan to reevaluate selling each of my holdings:

Rocket Lab — after Neutron starts recovering on the at-sea platform, and the firm deploys at least 20 flatellites

AST SpaceMobile — after the deployment of all planned Block 2 BlueBird satellites

Planet Labs — after the Pelican and Tanager deployments are complete

Amazon — after Project Kuiper starts generating positive free cash flow (like Starlink is thought to be doing now)

Oklo — after 5 customer reactors come online

In setting these criteria, my aim is to identify what I think is going to be the knee in the price curves, the inflection point after which I believe the companies’ growth rate will slow.

I generally think about these knees as technical milestones more than financial ones.

What I’m not doing is establishing a target price to sell. That would be the wrong move for me because I’m not trained as a trader. I don’t know how to anticipate what the market will value these milestones at.

Bear Cases

It’s not uncommon for growth stocks to be volatile, and that includes significant negative price swings as well. My general view is that if I see a drop in value of more than 60% of my initial investment (not the high-water mark), I will evaluate selling.

This is a financial criterion because my goal is to make money. I need to have a view on when to cut my losses, and that might not be related to technical progress for any given stock.

Other Cases

At this point, if I want to buy a new stock, I have to sell something I currently hold. My approach to that in the coming quarter will be to rebalance by selling Rocket Lab because it’s what I own the most of. Consequently, an implicit criterion for new investments is “do I think this will either outperform or perform in a way that’s uncorrelated with Rocket Lab over the expected holding period?”

This is not an optimal approach, but I think it’s elegant because it’ll also help solve my portfolio weighting problem.

There are two additional cases not really covered above where I’d consider selling:

If the CEO is replaced and the firm is no longer founder-led.

If the stock drops below 3% of my portfolio value.

Looking Forward

There’s an impression out there that great companies are being built today with all the gains captured by private investors. There’s significant anecdotal evidence for that between the exits of formerly VC-backed firms like Snowflake, Airbnb, and Snapchat, as well as the SPAC craze of 2021. This might be true in SaaS-dominated sectors and in all SPACs (due to redemption mechanics), but I feel strongly that this is not the case in deep tech IPOs and direct listings.

Generally, companies go public either because they need more new capital than they can raise in the private markets, or because existing owners need to sell to return capital to their own investors. Unlike many SaaS firms, deep tech firms often still have significant commercial progress to make at this point, so I frequently think there is material upside to owning the equity as an investor if it all works out.

The key to this, as with earlier stage startup investing, remains entry timing. Entry timing is critical because the price when the stock is bought will always drive the IRR and MOIC metrics.

From my perspective as a retail investor, “good timing” looks like the following things:

the IPO/SPAC/direct listing dilution is complete

no more locked up shares

at least 1 Form 10-K published since going public

stable number of shares

the firm is still founder-led

the technical milestone the company expressed in its IPO/SPAC/direct listing roadshow has not yet been achieved

All ETF price data came from Yahoo Finance, and is the closing price reported on the last trading day of the quarter. All stock price data came from Vanguard or Yahoo Finance, and is either the price paid or the closing price reported on the last trading day of the quarter.