Infactory: A startup snapshot

Good science produces reproducible results, and AI tools should too

I’m back this week with another startup snapshot! This week, I’m looking at Infactory.

I initially heard about this company when a friend from Terran Orbital went to work for the firm.1 He was a data scientist when we worked together, but I’d go as far as to say he was the best software developer I met there as well. I find elite technical talent compelling, and that’s the underlying reason for this startup snapshot.

Problem

One of the things the scientific method strongly suggests is that scientific experiments should be reproducible. This is one of the cornerstones of what constitutes “good science”, and is also directly applicable to engineering and math. This doesn’t appear to hold for questions asked of some AIs. I find this counterintuitive.

More broadly, it also seems like this should impact how much trust STEM professionals and institutions outside the domain of computer science are willing to give AI.

Since I see AI as a potential force for good in the world, that’s a big problem.

Solution

Infactory has created a proprietary Unique Query Methodology (UQM) to interact with databases. The claim behind the company is that the UQM can deliver deterministic AI-driven insights that are verifiable.

The idea is that this will create greater institutional trust in AI-enabled decisions. This should unlock institutional approval of AI to make more valuable decisions, and eventually safety-critical and health-critical decisions as well.

Founders

Brooke Hartley Moy (LinkedIn) is the CEO and cofounder. She was most recently the Strategic Partnerships Lead at Humane, which was a consumer electronics company that developed a voice-operated virtual AI assistant device. Prior to that, she ran strategic partnerships for Google’s communications product lines (Meet, Messages, etc). Earlier in her career, she spent time in customer success at Slack, account management at Spredfast, and escalation management at Salesforce. She’s a sales and customer service SME with a background in AI, which sounds like the right profile to get this off the ground.

Felipe Abello (LinkedIn, X) is the COO and cofounder. He’s a serial entrepreneur. Before joining Infactory, he was the founder and CEO of Nara (YC W22) which built AI chatbot personas, as well as the founder and CEO of Helloguru, a no-code data transfer startup. He started his career as the Head of Business Operations and first hire at Rappi, a Latin American digital commerce platform. He’s an experienced entrepreneur at the earliest stages who also has experience with AI as a domain.

Ken Kocienda (LinkedIn, X) is the CTO and cofounder. He also comes most recently from Humane, where he ran Product Engineering. The majority of his prior experience was at Apple, where he spent 16 years on the human interfaces team, and supported products from the iPhone and iPad to Safari. This is a really interesting profile for the head of the technical program, because his background comes across on the website as much more user experience-oriented than optimized for what I would think would be the startup’s tech stack.

This founding team comes across as having both a nuanced understanding of the problem space, and the technical chops to design an elegant product.

Market

I understand the purpose of Infactory as enabling AI observability and reproducibility. This sets the context of the market size.

Top-down

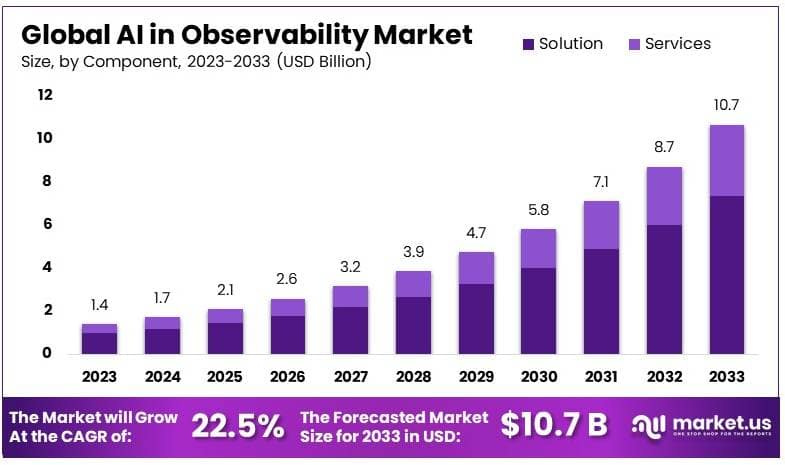

Market.us assessed that the market size in 2023 was $1.4 billion, with a projected CAGR of 22.5% over the next decade.

QKS Group thinks the market will be worth $3.6 billion by 2030, and will have a CAGR of 14.59% between 2025 and 2030.

Markets and Markets takes the view that the observability market was worth $2.1 billion in 2024, and will have a CAGR of 11.7% through 2028.

All these market sizes project a market size in the low single-digit billions, though there are disagreements about the market growth rate. I think this is at least in part a function of when the reports were written, but it’s worth noting.

Mirko Novakovic at Dash0’s top-down market size suggests a market size in the $40-50 billion range. On one hand, this seems way out of alignment with everybody else. On the other hand, it’s tied to actual AI spending.

Bottom-up

Normally I create a first-order estimate of the market size. But this time, I found a significantly more precise source that shows its work.

Those top-down market sizing research report numbers, particularly from Markets and Markets, sounded small to Mirko Novakovic, so he estimated the market size from the ground up, and shared his methodology.

He concludes that the market as of December 2024 was worth about $12.1 billion, and is growing at about 20% year over year. The growth rate seems broadly in line with what the top-down estimates project, which is noteworthy given how different his answer is on the size of the market. Notably, the growth projection here is less ambitious; it’s only evaluating year over year growth, so the growth rate may not hold past 2025.

If nothing else, I’m confident that this is a VC-scale market today, with a very attractive short-term growth rate.

Fundraising History

Infactory has a relatively light fundraising history. According to PitchBook, the firm raised a $4 million seed round on a $21 million pre-money valuation in Q4 2024. Bee Partners led the round. FJ Labs, Andreessen Horowitz, and Alumni Ventures participated. The purpose of the raise was fairly normative for this point in a startup’s lifecycle; the founders wanted to bring more people onto the team, and ramp up the go-to-market motion.

Selected Competition

Infactory accomplishes its reproducibility and observability goals by interfacing with data in interesting ways. This sets the scope for who I see as direct competitors:

Galileo AI evaluates and monitors generative AI applications at enterprise scale.

Fiddler AI is building AI observability tools in the context of a security play.

Arize is building a unified observability and evaluation platform to study apps and agents, and tweak them in production.

Observe is building a centralized data layer to organize information from multiple sources at scale.

LlamaIndex builds AI assistants on top of enterprise data.

Cohesity builds AI-enabled data management and security tools.

Technology

The top of the data pipe is pretty flexible. It support relational database solutions like MySQL and PostgreSQL, no-SQL databases like CosmosDB or MongoDB, as well as old-fashioned CSV and JSON files. That’s good business for a seed-stage startup because it creates as broad a prospective user universe as possible, but it is not groundbreaking.

The “secret sauce” is the UQM, which is proprietary. It’s what allows the firm to guarantee the same answer in response to the same question. This is the technology that’ll make or break the company in the short term. It’s also probably the best reason to consider Infactory deep tech, though I’m not sure that I do.

These UQMs are optimized to evaluate Slottable Queries, which form the basis of the interface. These are query templates that get prompted to users. These templates treat queries themselves like a function call, providing integration with the user’s business logic. The effect here is that end users can ask a wider range of questions of their data in a no-code or low-code environment.

The last two interesting features of this technology relate to how data is accessed. The tool requires access to customer databases, but doesn’t copy the data — which should make the product both more capital-efficient and more secure. Consequently, the tool operates at database query speed, rather than AI response speed; the former is significantly faster.

Progress

The Documentation available looks mature. It is a strong indication that the interfaces have been completely defined — which is historically one of the trickiest parts of any development or engineering project.

It’s more difficult to see what progress looks like in terms of actual development or deployment; the firm does not have any customer quotes or case studies on their website (there are abstract use cases in the Documentation). The state of the docs, and my confidence in my former colleague, make me think there’s at least a minimum viable product, but this is completely speculation.

Infactory has publicly shared its pricing on the FAQs section of its website. There’s a free tier, a Pro tier ($30/month for 10,000 API calls), and an Enterprise (call for a quote) tier. That demonstrates some significant progress on the sales motion, as figuring out what to charge is not trivial. At the end of the day, Infactory uses query-based pricing, which is very common in Cloud startups, and somewhat less so in AI startups.

Finally, Infactory’s Blog is fairly fleshed out for a seed-stage startup. This is not progress towards a ready-for-Series A metric per se, but it shows that the startup has a nuanced view of its market as well as the role it plans to play in it.

If you invest in startups, like my writing, and want to chat about possible career opportunities, don’t hesitate to be in touch. The best way to get ahold of me is via email:

Assumptions

In order to seriously consider this startup as a potential investment candidate, I’d need to be comfortable with these key assumptions:

Understanding how an AI thinks will make a large population of users with a willingness to pay more willing to hand off valuable work to that AI.

Implementing reproducible outputs in AI will make a large population of users with a willingness to pay more willing to hand off valuable work to that AI.

This founding team is going to stay on the bleeding edge of AI-adjacent tooling for the next 12 years.

Key Open Questions

If I had more time, these are the most significant questions I’d dig into.

What percent of AI users are willing to pay for answer reproducibility, or process observability?

What’s going to stay sufficiently unique about the service that some acquirer (or the public markets) are going to pay a premium for this firm in 10 years?

Alternatively, what’s in the product pipeline that demonstrates evidence of continuous innovation?

What’s the profile of the next hire the founders are looking for?

Final Thoughts

The grand technical vision of Infactory is that AI will become consistent and provide reproducible outputs. If the firm executes on this, and can maintain a competitive advantage, it’s got potential to be a great AI company — and should be priced like one.

There’s a significant secondary promise here, which holds regardless of whether that radical dream is achieved or not. Infactory also claims to be creating a faster, and potentially cheaper, way to connect databases, AI, and application interfaces. In this sense, Infactory is building software infrastructure.

Investors I know and admire are asking tough questions about what exactly it means for AI to be infrastructure. My impression is that the generalist model space already has massive incumbents, and the key wedges for most early-stage startups these days are distribution and the interface. There’s definitely interest in vertically specialized models, but from my perspective the field does not seem quite as popular.

Infactory provides a potential resolution to this dilemma by positioning AI as a tool that is as reliable as a database query.

When investors outside AI invest in infrastructure, one of the things that matters most to them is that the investment is consistent — it doesn’t matter whether they’re talking about software on the cloud, or a power plant supporting the electricity grid, or something in between.

The fundamental thesis of Infactory is that this view of reliability in infrastructure applies to AI as well.

I do want to clarify that I had no conversations with him about this post before publishing it. This post relies exclusively on publicly and commercially available data, and my impressions of him from our time together as co-workers.