How mature is quantum computing in 2026?

Investors are both early and late to the sector — at the same time

One of the things that challenged me at the start of business school was the frequency with which professors would answer questions “it depends”. It was great practice though — I’ve come to see that it’s absolutely how business (at least at early-stage startups) works.

I required a period of adjustment since it wasn’t how I was trained to think as an engineer. In test engineering and software development, most questions I encountered could be answered either “yes” or “no”.

Quantum computing is different from both test engineering and business. In this field, the answer is frequently both “yes” and “no”. It is an area of growing interest for me at work, and I’m excited by lots of the startups I’m seeing in the space.

As somebody who’s new to the quantum industry, and invests in startups, I’ve been thinking a lot about timing in a macro sense — are people considering investing in it for the first time early or late to the game?

I actually think the answer right now is both!

I write Molding Moonshots in a personal capacity.

If you are building in deep tech and thinking about raising pre-seed, seed, or Series A funding, I’d be more than happy to have a chat on professional terms!

Send me an email and we’ll find a time.

Early

The key reason I believe this is that the overwhelming majority of firms and consumers today have no immediate need for quantum computers.

Quantum computers are incredibly expensive, and many rely on technologies that don’t seem to be fully understood.

That makes lots of people today — even in the world of startups — uncomfortable, because it breaks our mental patterns for technology development in unicorns.

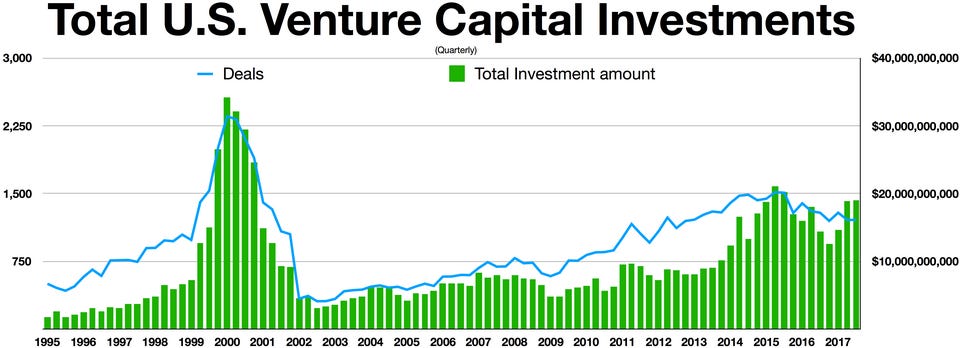

For at least the past thirty-ish years, certainly since the dot-com bubble, consumer technology — particularly in software — has been a core focus of corporate R&D efforts.

Websites and apps that solve immediate needs and wants are matured specifically for the desires of their users.

These products came to solve a specific problem.

Their designs reflect it.

Facebook, X, Instagram, even LinkedIn all look a certain way because some User Experience designer did some research and determined that just about every element of the interface supported some desirable user behavior, or minimized the likelihood of some undesirable user behavior.

The communities of funds, accelerators, employees, and such that have developed around entrepreneurship in the US over the past decade also reflect this approach.

Accelerators are important

Y Combinator recently ran their Summer 2024 Demo Day. This semiannual (soon to be quarterly) event generates a lot of news in the startup world.

Perhaps the best example of this is Y Combinator, whose core message to founders is “make something people want”.

Prior to the internet, that’s probably how some R&D was done, but not nearly all of it.

IBM, for example, shipped early mainframes (the forerunners of modern servers) without any software. It saw large computers certainly as a tool, like the calculators it was used to selling, but it seems to have not had enough insight into its customers’ problems to write software for them.

This IBM mainframe model is what the quantum sector seems to be working towards. Lots of firms are building computers. However, nobody has such an immediately clear and profitable use case that there is a design reference problem which these companies are competing with each other to solve using quantum computers.

Identification of a suitable end user problem and development of at least some software seems likely to remain an exercise left to the buyer for quite some time.1 This is the most significant reason I think we’re in the early innings of quantum computing.

There is a second, unrelated reason why I think people just starting to explore the quantum computing industry are early, at least as far as deep tech goes:

Nobody has written a definitive book on it yet!

I love to read, and see the publication of books as crystallizing an industry’s development by providing a snapshot of the state of the art at a single point in time.

The best example I can give of a book in another industry which fills this niche is Space Mission Engineering: The New Space Mission Analysis And Design, which describes the design of modern satellites in deep detail. Between all the places I’ve worked in the satellite sector, I don’t think I’ve seen a team without this book on somebody’s desk.

The absence of a leading technical book, or textbook, or industry history book, to refer to industry newcomers is strong evidence to me that we’re still early in the history of the quantum industry.

Late

Quantum computing is a space investors across stages are excited about. Including late-stage investors. Including investors in public equities.

Unicorns in the quantum sector include:

PsiQuantum, last valued at $7 billion

SandboxAQ, last valued at $5.6 billion

IQM, last valued at $1 billion

Public companies in the quantum sector include:

IonQ (NYSE:IONQ, market cap of $17 billion)2

IonQ bought Capella Space

·Earlier this week, IonQ announced that it completed the acquisition of Capella Space in what was reported to be an all-stock transaction.

D-Wave Quantum (NYSE:QBTS, market cap of $10 billion)

Rigetti Computing (NASDAQ:RGTI, market cap of $8 billion)

Quantum Computing (NASDAQ:QUBT, market cap of 2 billion)

To be fair, seven unicorns doesn’t necessarily mean all the hard problems in the field are solved. Heck, it doesn’t even mean any of the hard problems are solved — plenty of unicorns go on to futures that are less stellar than investors hope.

But it does mean that there’s significant capital aware of the opportunities in this sector and investing in them.

Quantum computing isn’t a consensus sector yet, but it is far, far less non-consensus than it used to be.

In that respect, investors just getting up to speed on the technology right now are late to the game because this is not a sector that later-stage funds haven’t heard of.

Having said that, being late doesn’t mean there’s not great investment opportunities in the sector.

I’m very optimistic about where quantum computing as an industry is going to go in 2026!

This is a really curious place to me, because I think it’s where the space industry was about ten years ago. As an undergraduate student trying to break in at the time, it was decidedly uncomfortable.

Market caps are as of closing on 8 Jan 2026.