Corvex Systems: A startup snapshot

The new kid on the block for UAV motors

I’m trying something new this week: a snapshot about an early-stage startup.

The specific subject this week is Corvex Systems, a UAV hardware vendor.

Problem

Unmanned Aerial Vehicles (UAVs) or drones have become critical in a variety of defense and commercial applications. Most drones, as well as drone components, are produced abroad and imported to the US.

This is a national security concern, especially when our “pacing threat” is home to key vendors. In particular, Chinese firm DJI is a leading supplier. In fact, earlier this week the firm announced it will stop geo-fencing their drones.

Beyond the national security implications of drones obstructing airports and air bases, it’s not good to have drone supply chains reliant on foreign suppliers because it would be bad for a number of industries, from agriculture to insurance, if drone technology became subject to sanctions or more stringent export controls. This isn’t an impossible situation — US-made drones are subject to export controls at least as strict as Export Administration Regulations, which covers dual-use technologies.

Corvex has published an essay describing the problem they’re looking to solve in more detail.

Solution

UAVs are a category of aircraft.

As such, they contain a number of subsystems — not all the ones on crewed aircraft, but at the very least propulsion, electrical power, flight control, and avionics.

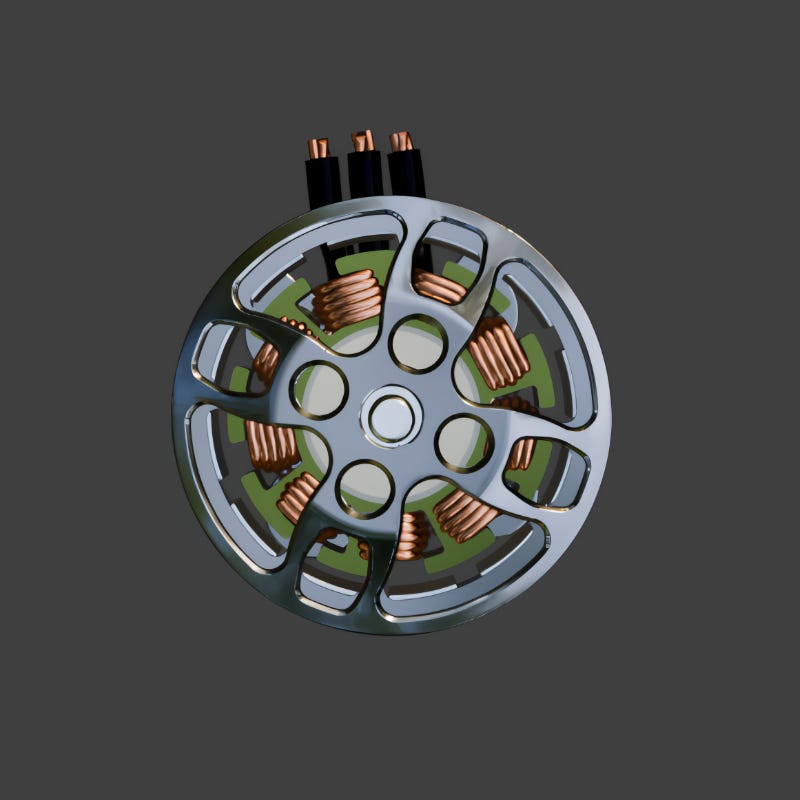

Corvex’s current approach is to become specialists in the propulsion subsystem, and focus on building drone motors. Their initial product, Raven, is a Brushless DC (BLDC) motor.

Raven will be available with Kv ratings from 2000 RPM/V to 500 RPM/V. These motors are going to be small — from 72g to 131g, and with a constant shaft diameters of 5mm.

They’re also going to be low voltage motors, with the 2000Kv motor taking not more than 12V and 5A, and the 500Kv motor taking not more than 25V and 40A.

Taken together with their messaging, these product specs show that the firm is interested in what are really three separate markets:

hobbyist drone users, and perhaps builders

defense drone vendors

commercial drone vendors

This isn’t defense tech, but it’s definitely dual-use.

The unit price is $35-$95 for pre-orders. I’m no drone expert, but from some quick research, that seems slightly higher than comparable parts from foreign companies in the civil/commercial market.

This seems smart.

Founders

Corvex is led by a pair of co-founders, supported by a technical consultant.

Jason Blick is a co-founder. He’s a US Navy veteran who worked on integrating electronic systems. After transitioning back to civilian life, he built up experience in industrial automation, and managed a power supply manufacturing line. He’s working on process and documentation development for the first Raven production run.

Anthony Kenneth is a co-founder. He studied Economics at the University of San Francisco, and prior to founding Corvex did accounting for non-profits. Now he’s building supplier relationships and building financial models.

Lee Zhang is a technical consultant. He holds a master’s degree from Tsinghua University in Electrical Engineering, and has ten years of experience as a lead engineer building motor manufacturing equipment at NIDE, a firm that builds motor manufacturing machines.

It is very tough to learn about the co-founders online; the only presence I saw was Jason’s X account. This makes it difficult to learn more about the team, and develop a perspective as to whether or not they’ve got founder-market fit. From the limited information they’ve shared, I think it’s quite possible that they have it, but there’s just not enough information for me to have high conviction that they do.

One last point here — as of the publication date of this post (January 17) they are seeking two more people for their founding team. People who are interested should reach out to them via their website.

Market

Top-down

Corvex claims that the North American drone motor market was worth about $0.9B last year and will be worth about $3.4B by 2031 — a CAGR of nearly 19%! I’m pleased to see the geographic and time restrictions on their analysis, but I still want to double-check it.

Looking at the ending market value and time forecast, this assessment seems relatively conservative. Top-down market sizing websites that I use project numbers farther into the future from $3.3B all the way up to $9.9B.

The US DoD is expected to remain a key purchaser of drones, in almost all these analyses, and commercial use is expected to drive a significant portion of the increased demand.

However, not all drones are going to be suitable for the motors Corvex builds.

Based on Corvex’s framing of the drone manufacturing market with respect to DJI, I expect the firm to specialize in motors for quad-copter drones. These tend to be smaller and seem to use similarly sized motors to what they’re building. As of 2022, they were 71% of the global drone market. Assuming that market share holds for the US in the future, and working with their numbers, their TAM is closer to $2.4B.

Bottom-up

Because drones are regulated, this is actually a fairly simple bottom-up market sizing exercise. DoD acknowledges operating around 11,000 UAVs, and some of these are the most expensive ones around. As of December 2024, there were more than a million drones registered with the FAA — about 403,000 were commercial registrations, and 387,000 were recreational registrations.

But these registration numbers don’t tell the whole story. Lots of drone fleet operators used to be able to register their whole fleet under one registration; while that policy has changed in the past year, I don’t get the sense that everybody who is subject to it has come into compliance. Let’s say the average drone fleet is 3 (it’s probably bigger), so I think there’s 1.21 million commercial drones in the US.

Similarly, not all hobbyist drones require registration; many of the cheapest and most accessible drones are so small that the FAA doesn’t regulate their use as stringently. I’m going to conservatively estimate that there’s 2x as many recreational drone users as registrations.

In total, I think there’s about 1.99 million drones flying around the US today. In Q3 2024, the US economy grew at an annualized rate of 2.8%. I’ll use that as the CAGR, since I believe drones won’t grow more slowly than the economy as a whole; they may not grow at the exponential rate Corvex anticipates, but I’ll be confident if the numbers seem okay here that there won’t be a problem.

In 2031, I expect to see about 2.42 million drones flying around the US.

Let’s say that 71% quadcopter number from the top-down exercise holds, that means that there’s going to be a need for about 6.87 million motors running on quadcopter drones that year.

If the average drone lasts 3 years,1 the average motor sells for $75 — which is in the middle of what Corvex is offering on pre-orders, and Corvex controls 25% of the market, they’ll be doing $42 million in revenue in 2031.

That number assumes they introduce no new motor product lines, don’t enter the motor market for higher priced drones, and enter no new drone subsystem markets.

That’s not outstanding, but even with my pessimistic assumptions, it’s a respectable number with real potential for a VC-scale outcome several years after 2031, if investors can get in at the right valuation in 2025.

Fundraising History

Corvex Systems is very young, even for an early-stage startup. Its earliest dated online presence went live no earlier than January 11, 2024. It is not on PitchBook, Crunchbase, or CB Insights, which is where I’d usually go to start sketching a startup’s fundraising history. Google’s search results about the firm are sparse as well. It seems they have no public fundraising history, which is unsurprising given the firm’s youth.

They are either on the market right now, or will be shortly, looking for seed stage funding.

Selected Competition

DJI is a leading vendor of drones based in China

iFlight sells drones and is based in China

T-MOTOR sells UAV power hardware, and is based in China

KDE Direct sells BLDC motors and is based in Oregon

EMax sells BLDC motors and drones

Technology

The product’s technology here is BLDC motors. These are commoditized electromechanical components — as long as devices meet the same physical, electrical, and mechanical specifications, they are interchangeable.

Based on what’s been shared publicly so far, it’s not clear whether there’s an improvement in the underlying technology. I hope there is, but I’m not sure that they need it to be commercially compelling.

There may also be manufacturing process improvements. Their website talks about automation, but it’s not clear how automated the current state of the art is — or what the state of the art in the US looks like.

This is a potentially interesting investment candidate less because of unique underlying technology and more because of where the market is expected to be in a few years. That sounds very healthy to me.

Progress to date

The firm has accomplished two key things so far.

First and foremost, the company has designed the initial version of their hardware. It’s tough to have a hardware startup without a product vision, and being confident in a first version that they’re ready to scale up production and take pre-orders is a fantastic place to be given how young the startup’s public presence is.

The other is that the firm has acquired a fabrication facility, which they call FAB1. It’s located in Reno, Nevada. The rationale for this location is about both shortening the upstream supply chain (there are rare earth mineral deposits in the state), as well as locating the facility close to companies that do high-volume manufacturing in the region — like Tesla.

Assumptions

In order to seriously consider Corvex as a potential investment candidate, I’d have to accept these key assumptions:

Regulatory tailwinds will drive American drone manufacturers to US component suppliers, and this will persist for the long-term.

Successful drone component vendors will get a fair, if not premium, valuation on public capital markets within 15 years.

Corvex’s assessment that motor designs will be suitable for multiple market segments is correct.

Key open questions

If I had more time, these are the questions I’d dig into.

Why is this the problem that the founders are pursuing?

Will multiple startups win in the drone motor space?

Why will this be one of them, or perhaps the only one?

How similar are customer needs across the hobbyist, commercial, and defense drone spaces?

Which does Corvex feel has the most potential for the firm, and why?

What will it take for Corvex to get to a billion-dollar valuation as a producer of a hardware commodity?

Recommendation

Corvex is on the market, and looking to close a seed round by Q2 of its FY 2025, which ends this coming March.

Frankly, there’s a lot of information missing. I simply could not get to “yes” with what the firm has shared with the public. Having said that, I’m quite convinced that this startup is solving an important problem, and that it’s operating in a large market.

I would be interested in spending more time learning about Corvex and its founders.

Based on reddit, my impression is that drone operational lifetimes are highly variable. I’ve read about drone use times measured in minutes in Ukraine, all the way up to 5+ years for drones operated by skilled pilots for hobby and commercial purposes.