Analyzing Arc

Inversion Space's new approach to delivery from orbit

Outer space is such an alien concept that on some level, even to those of us who have sent things there, it feels very, very far away. Parts of outer space are — but other parts of space are actually quite close.

For example, the International Space Station, in Low Earth Orbit, circles the Earth at an altitude of 250 miles. That’s about 60% of the driving distance between San Francisco and Los Angeles according to Google Maps. At that height, satellites move at around 17,000 mph, so they cover that distance in about 53 seconds.

Furthermore, in orbit, the Earth spins under the spacecraft; in the right orbit, any point in the whole world is eventually not much more than 250 miles away. Spacecraft slow down significantly when they enter the atmosphere, but for a big enough constellation, reaching any point on the globe within a matter of minutes is quite practical.

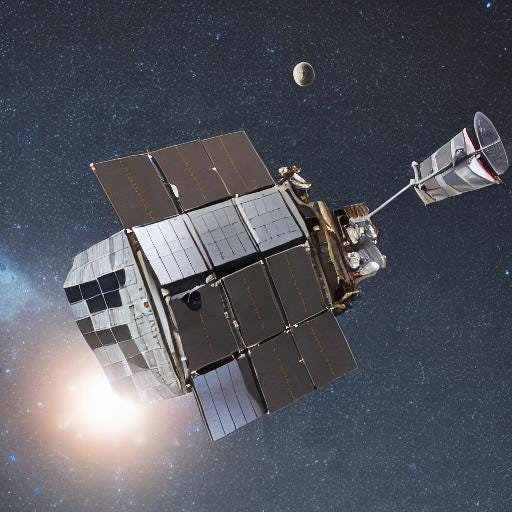

A couple weeks ago, Inversion Space announced the Arc architecture. Arc is a reentry vehicle designed to be capable of delivering cargo to any point on Earth in less than an hour.

Inversion is a fascinating firm, and it is particularly interesting to me because Dorm Room Fund, which I’m an alum of, invested in the startup several years ago.1

The Media

I watched the two minute product announcement video several times.

Then I watched a video analyzing the vehicle by Scott Manley, a space content creator.

Then I watched the founders react to Scott’s analysis in the video below.

The Tech

Here’s the concept of operations from the video:

A constellation of Arc reentry vehicles, each with an attached service module, is launched to a variety of orbits.

On demand, the reentry vehicle separates from its service module and slows down in order to fall out of orbit.

Shortly after entering the upper atmosphere, the vehicle gains the ability to maneuver both downrange (forward/backwards along the initial trajectory), as well as cross-range (shifting the trajectory to the side - which is something not all reentry vehicles can do).

At some point, the vehicle will slow down to a point where it’s no longer moving faster than the speed of sound, and also in the general vicinity of the landing site. At this point, a controllable parachute will deploy.

The vehicle descends the rest of the way to the ground under the parachute canopy.

Inversion Space has a meaningfully differentiated concept of operations and end user — no other companies that I’m tracking have hardware visions quite like Arc:

Varda Space Industries uses capsules to return medicines (the marketing material is explicitly positioning the firm as a life sciences company), and has historically returned capsules with a parachute onto dry land

Reditus Space plans to manufacture a broad variety of products in the zero-g environment, and looks like it plans on returning them with a parachute into water

Sierra Space is building a larger lifting body, Dream Chaser, and says it’s going to land on a runway

Intuitive Machines recently announced Zephyr, a lifting body (like Dream Chaser and Arc) to take products manufactured in space (like Varda’s and Reditus’s vehicles) back to Earth, earlier this week

Boeing built the X-37, which looks much more like the space shuttle and is exclusively for government missions

Though the founders weren’t explicit about it in their review of Scott’s video, I think Arc’s anchor customers are likely in the defense and intelligence communities because of how they discussed:

the capacity of the system to return multiple vehicles at once

synchronizing vehicle arrival times

the characteristic of being either refurbishable or single-use/attritable, at the customer’s option

In the videos, everybody assumed a five year orbital lifetime. That’s broadly consistent with my understanding of how long satellites last in low earth orbit. What was not discussed, and maybe what I’m most intensely curious about was the orbital lifetime of the prospective customer payloads.

Inversion Space intends to use space as a storage facility for things like:

advanced electronics

radiation detection gear

biological products meant to go into humans (blood for transfusion, medicines)

ammunition

I have no clue how five years in the relatively high-radiation environment of orbit will affect the efficacy of these products, but I doubt they’ll all be as good after five years in space as they were on launch day. I have to imagine that how often the payloads need to be refurbished or replaced will also have an impact on the ultimate cost to users of the system.

Scott, the YouTuber, made a bunch of assumptions and estimated that about 40 spacecraft would be needed in order to achieve the one hour delivery timeframe. Inversion Space’s cofounders believe that number is in reality lower.

It’ll be interesting to see what the numbers are — though I suspect at the end of the day that the general public may not actually know, as it could be desirable for certain customers to keep that information private.

In any event, it’s clear that the number of spacecraft needed to execute the firm’s mission for a single customer will be at least one order of magnitude lower than the megaconstellations operated by telecommunications providers like Starlink. However, since the spacecraft need to be able to separate and execute a controlled reentry on a moments notice, they’ll also be at least an order of magnitude more complicated. That’ll definitely drive up the unit cost.

The Money

According to PitchBook, Inversion last raised money in November 2024 — a $44 million round co-led by Spark Capital (which followed on) and Adjacent. The key purpose of the financing round was to build the first Arc vehicle.

A post I put together about a year ago had a graphic which suggests that hardware founders were selling about 18.8% of their startups at Series A. I’m sure the number has moved a bit, but I doubt it changed by all that much before last November, so I’ll use it here too.

Assuming the raise in November was all equity, and also the founders took average dilution, that implies Inversion Space was worth about $234 million a year ago. In light of their somewhat successful test earlier this year, I expect the firm is worth more now — but I doubt we’ll get confirmation of this until they go to market again, probably after Arc’s first end-to-end test.

One thing I think this design highlights is that a developed space economy requires multiple options both to take things up from Earth to space, and to take things from space down to Earth. While launch vehicles have necessarily been in the zeitgeist since the 1960s, this might be the first time we’re seeing meaningful commercial competition among spacecraft specially designed to bring cargo back to Earth.

The current state of affairs is necessary but not sufficient. The industry can’t stop with only a couple competitors, and it certainly shouldn’t stop while none of the spacecraft in question are human-rated.

The key here will be the development of commercial customers. I think it’s likely that Inversion has customers for Arc lined up throughout the defense value chain, from other contractors to government institutions.

In terms of direct sales to the government, the startup’s contention is that even with launch costs it’ll be cheaper to have a few small caches of supplies in space which can go anywhere quickly than lots of small caches around the world which can also get anywhere quickly. I believe it, though I also wonder whether it’s a good idea in terms of national strategy (rather than startup strategy) to cut the amount of pre-positioned supplies we have easily accessible.

In terms of contractors, the idea so far seems to be that Arc’s controllability at hypersonic speeds means it will be a good representative threat to test systems designed to stop hypersonic weapons.

But success as a dual-use firm requires commercial customers as well, and it’s not clear to me just yet who’s going to be buying Arc services. Maybe they’ll find success with pharma companies, as other firms in the space have?

Final Thoughts

It’s really refreshing to see a startup iterating on designs for reentry vehicles rather than rockets or busses.

One of the things I’m still mulling over is whether or not Arc has to be a post-Starship architecture?

This is generally an important question to ask of startups in space these days, because being able to reach their full potential before Starship does changes when the firms could grow rapidly — which matters to any investor with stakeholders who care about Internal Rate of Return.

If you’ve got thoughts on this, please let me know in the comments!

The investment was made before I joined DRF.

This post was made exclusively from commercially or publicly available information, and my own experience in the aerospace industry.