I spent this past week in Israel. The reason for my trip was to attend the wedding of my chevruta, my close friend and text study partner, of the past ten years. I also took the opportunity to reconnect with friends and family who live around the country.

When I think of Israel, the first industry that comes to my mind is agriculture.1 I spent half of my pre-university gap year (where I met my chevruta) volunteering on an agricultural youth village. My understanding of Israel as a modern and pre-modern polity is linked inextricably to growing plants and raising animals.

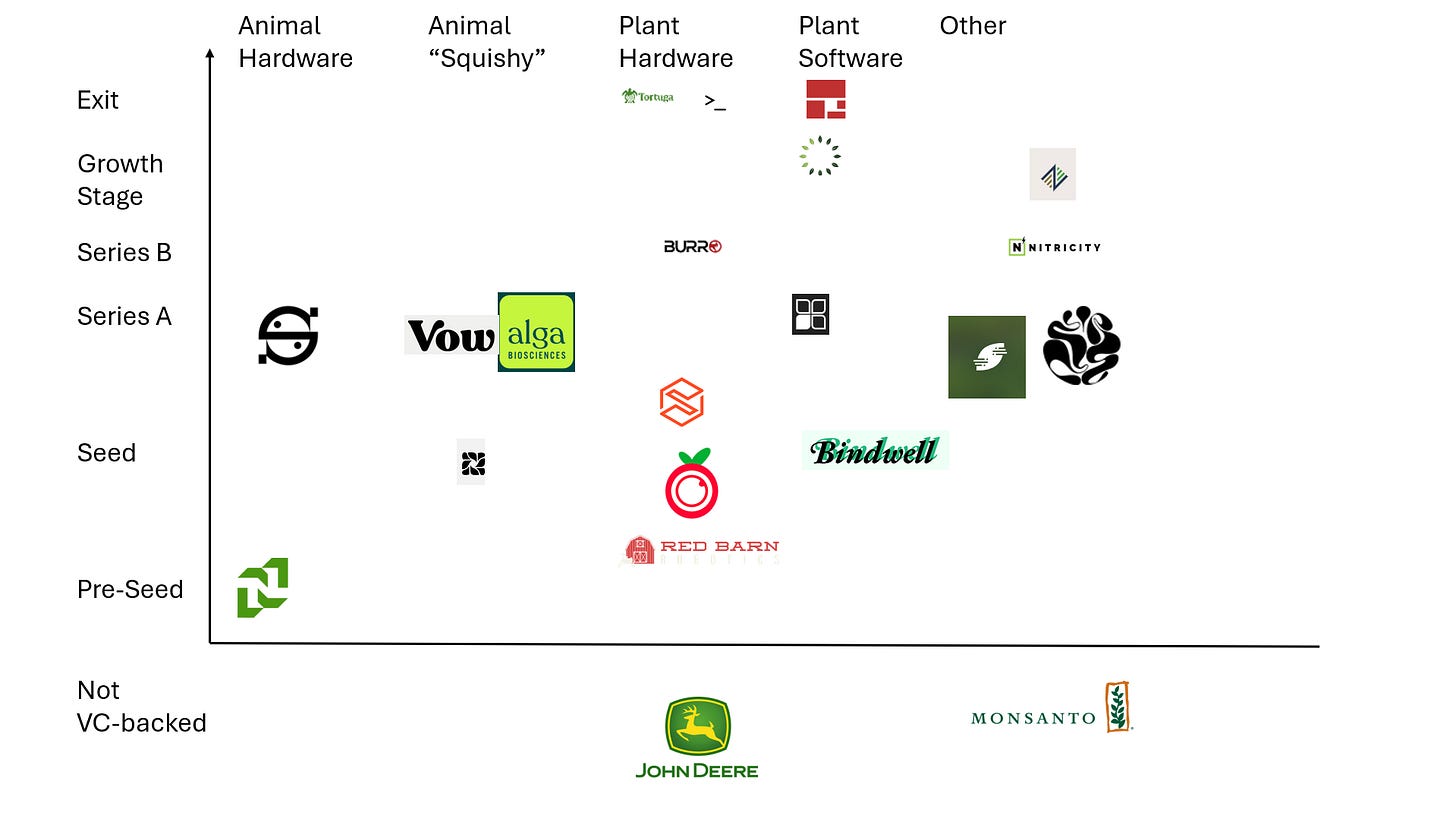

This week, I am particularly pleased to share an agricultural technology market map and investor list.

Startup Map

This map shows venture-backed startups and selected other companies that I’m tracking as:

solving problems most critical to generating more economic value out of agriculture

using agriculture in the most commercially interesting ways

infrastructure enabling the above spaces

incumbents in one of the above spaces

There’s a conversation to be had about whether or not a few of the startups building software products are truly deep tech or not — most have some sort of technical innovation, but some are very much business-to-business software as a service firms.

I think it’s important to include even the ones that are not deep tech in the market map because they contextualize the state of the art in this industry.

Key Verticals

Here are links to all the startups in the market map.

Animal Hardware

Animal “Squishy”

When I describe a startup as “squishy”, what I really mean is that it’s producing biological products or utilizing biological processes. It’s not making money off of code, or the electrical or mechanical products that I normally think of when talking about hardware. These firms are quite literally dealing with things that are squishy.

Plant Hardware

Plant Software

Other

This section contains firms that don’t fit nicely elsewhere. It’s mostly companies that manufacture products using biological processes. Nitrogen is the most common product.

Investors

Here’s a list of all the active financial, institutional, VC or growth equity investors in the startups above (according to PitchBook) that invested in a startup on the map through a pre-seed round, a seed round, or a round with a letter name.2 Firms that have a multi-stage strategy are shown at the first stage where they’ve invested in the field. Within each stage, firms are listed in alphabetical order.

Seed

Series A

Series B

One of my learnings from the last market map I put together is that the value of a sector-specific investor list is highest through Series B.

By the time startups reach a Series C, the financing rounds that close are relatively few and relatively large, so the investors become more generalist. Series B is where I’ll be ending my investor lists for the foreseeable future.

Note that this is distinct from the economic sector I associate most strongly with Israel, which is tech, in that an industry requires producing goods, and modern tech is services-oriented.

Excluded categories of investor are: accelerator programs, private equity funds that do not specify a focus in VC or growth equity, buyouts, family offices, angel investors and syndicates, corporate venture capital funds, funds of funds, hedge funds, generalist asset management funds, impact investors, and purchasers of secondary shares. Firms that do not have a website link on their PitchBook page are also skipped.