I had a great winter break — I went on a family vacation, watched a brother earn a PhD, wrote a couple other blog posts, etc. Over the past three weeks, I also have sought out things to read that have less to do with things I have a professional interest in, or find myself gravitating towards. I used this time to expand the breadth of my reading across both genre and subject matter.

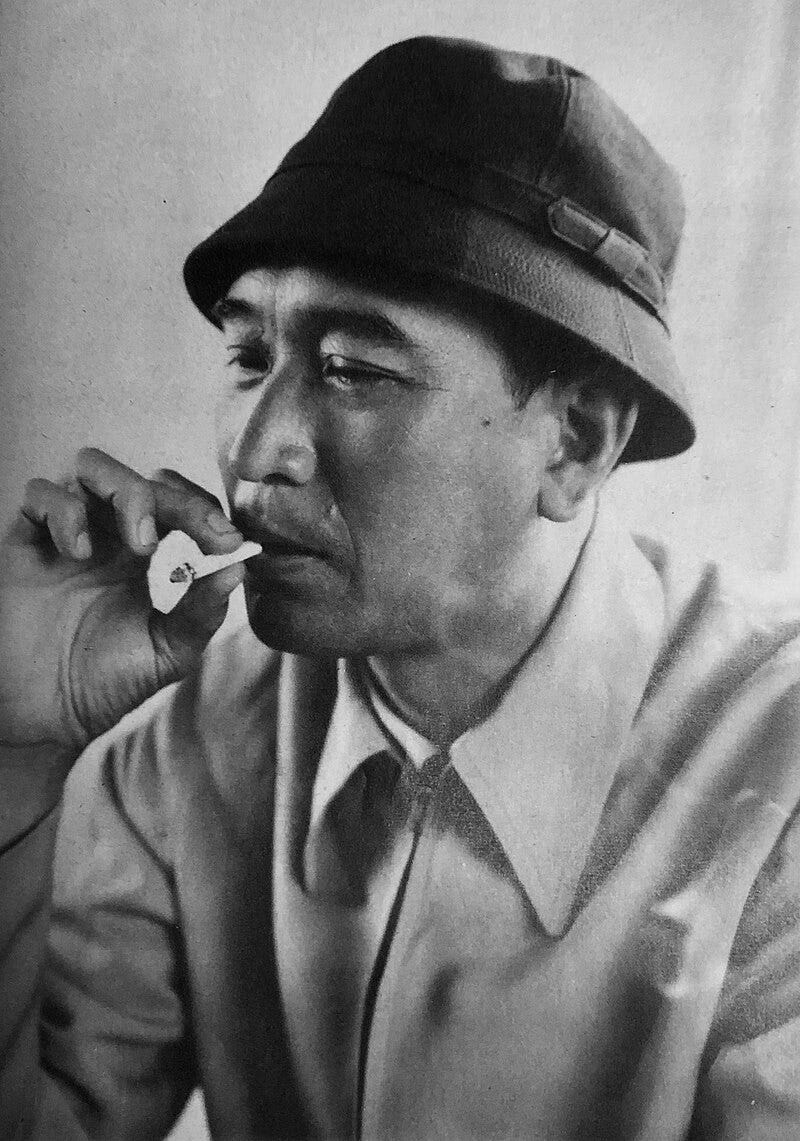

When I was in Boston on 11 December, I met up with a friend from overnight camp at a used book store. I found a copy of SEVEN SAMURAI and Other Screenplays by Akira Kurosawa. Kurosawa was one of Japan’s most culturally influential filmmakers, and I wanted to read his scripts in translation having seen some of his work. I remember in particular watching Dersu Uzala before my trip to Japan last summer, and attending a couple lectures at Columbia that were built around his films. Kurosawa’s work also apparently had a pretty big influence on the original Star Wars films, and I wanted to see if I’d pick up on this from reading a few of his screenplays.

Ikiru reminded me of Kundera’s The Unbearable Lightness of Being, though the former predates the latter.

Seven Samurai I struggled with — I’ve read scripts for stage productions before, but so much of this screenplay in particular was about the motion of the camera (which is not something I’m at all familiar with) that I’m not sure I understand why this is so great. I guess I’d better put the movie on my list.

Throne of Blood is fairly clearly a Japanese riff on Macbeth — and from the screenplay, it looks like a good one.

While I was in California, I started reading Web3: Charting the Internet’s Next Economic and Cultural Frontier, by Alex Tapscott. I had some brief exposure to cryptocurrency as an undergraduate on the technical side, and couldn’t figure out what was compelling about it from an engineering perspective — it just seemed like write-only linked lists to me. Cryptocurrencies have taken off since then, and I’ve also become more nuanced in my opinions on investing and economics. I’m still a skeptic — I believe in the SEC as the guardian of retail investors — but I figured that enough had changed both about me and the field to warrant reading a book focused on the cultural and economic impacts.

I’m still not interested in unregulated securities like cryptocurrencies as investment products, but Tapscott makes some really intriguing points about the cultural potential of Web3, which were reinforced for me by events surrounding the MIRA token on X over the past couple weeks.

Lastly, I read The Economic Consequences of the Peace by John Maynard Keynes. Never having studied economics before coming to Booth, I’ve taken three economics courses over the past four academic quarters — Microeconomics, Business in Historical Perspective, and Macroeconomics & the Business Environment. I thought the content of Macroeconomics & the Business Environment was the most interesting, but the structure of Business in Historical Perspective (a case-based course) resonated more with me. So I picked this up to dive deep into a macroeconomic event that shaped the 1900s — the negotiations that ultimately led to the Treaty of Versailles.

It was everything I expected of it and nothing I didn’t; I thought he had meaningful and interesting critiques of the plan.

I also read a couple of things that weren’t books, but that were significant enough to warrant a mention in this list.

The “U.S. House of Representatives Staff Report on Antisemitism” was released on December 18.

The document was surprisingly short (43 pages including footnotes), and unsurprisingly depressing.

I wrote last year about how I believe VCs should study nuclear strategy. When the Center for Strategic and International Studies released “Confronting Armageddon: Wargaming Nuclear Deterrence and Its Failures in a U.S.-China Conflict over Taiwan” in December, of course I read it!

I was intrigued by the game designers’ big conclusion: “The key takeaway is the difficulty in predicting how nuclear escalation will end”; I’m still working through how this might be meaningful for startup investing.