It’s good to be back on campus at the University of Chicago! Classes at the Booth School of Business don’t pick up again until the end of the month, but I came back early to help my colleagues who are just starting in the MBA program prepare for recruiting.

The world’s first artificial, controlled nuclear reactor, Chicago Pile-1, was created on campus underneath a squash court, so it’s an appropriate week to take a look at startups tackling problems related to nuclear fission.

Today, the reactor site is marked by a granite slab with a landmark. There’s also a sculpture, called Nuclear Energy.

And in true University of Chicago fashion, they turned a perfectly serviceable (though probably rather radioactive) athletic facility into a monument and a library.

This is what it looked like when it changed the world.

Why Fission?

Not all VC is deep tech, and not all deep tech is VC-backable.

In order for something to be deep tech as I use the term, there needs to be a new scientific or engineering innovation that has not yet been brought to market.

In order for something to be VC-backable, there needs to be real potential to get VC-scale returns on an investment into a startup in the field in a VC’s timeframe, which is typically 10-12 years.

Fission reactors take the power that comes from splitting atoms (conventionally Uranium or Plutonium) to heat water that turns a turbine and generates power.

Fusion reactors…don’t exist yet; a controlled, self-sustaining, artificial fusion reaction for a commercially significant period has yet to be achieved.

As a result, I don’t see the mature development activity in fusion yet that would make it something I’d be excited to back. I see lots of mid-to-later-stage research experiments, some of which are run by startups, which make me think that’s likely to change soon. But not quite yet.

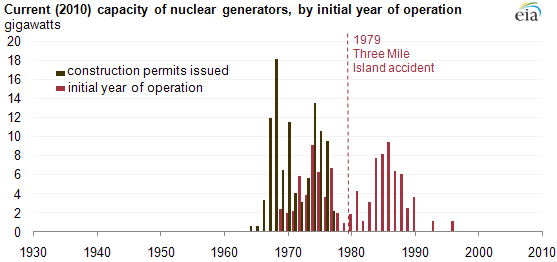

The science underlying fission reactors for power generation is pretty well understood, and we used to build them in significant quantities.

Although construction has certainly tapered off over the past few decades, we’ve seen a lot of interesting engineering innovations in the fission space over the past several years, alongside a regulatory landscape that’s becoming more friendly at both the federal and state levels. Illinois, for example, recently repealed a moratorium on new reactor construction.

Furthermore, we know there’s a market for commercial fission, because one exists today. Just because we’ve stopped building reactors doesn’t mean we’ve stopped running them.

It is a tough market. There are multiple levels of burdensome regulation just to enter; the key agency at the federal level the Nuclear Regulatory Commission, and there are others. The market is also potentially monopsonistic because electricity today is sold by utilities at commodity prices.

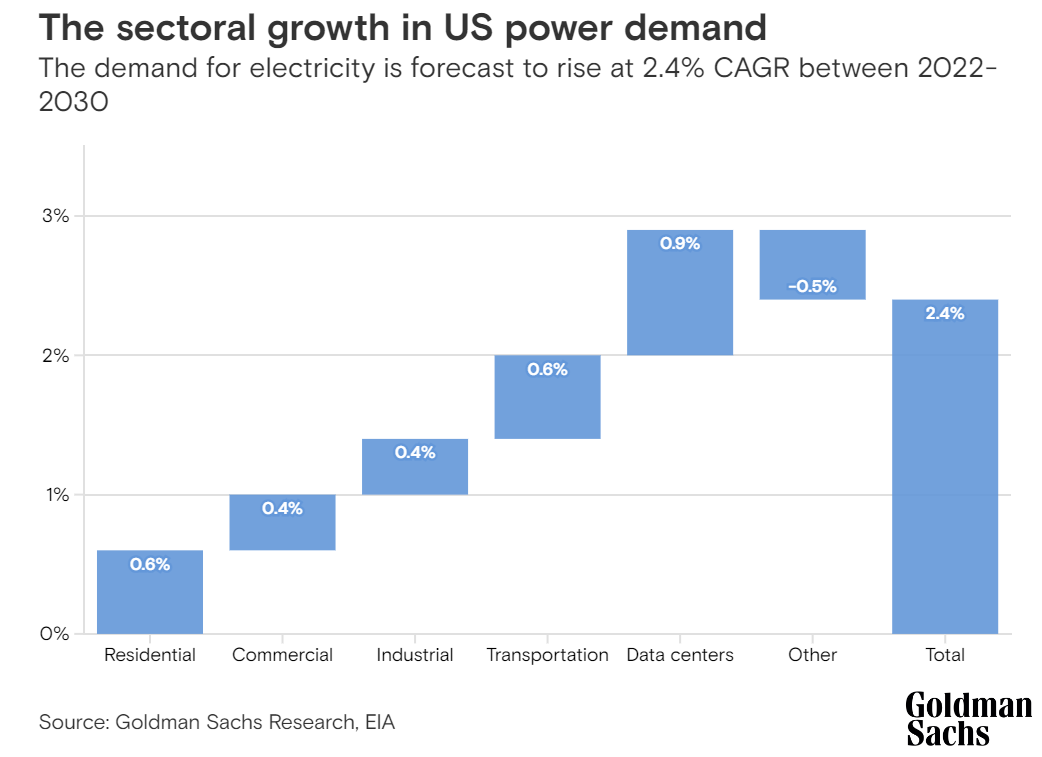

But the power market in the US is also huge, and growing in a way that will require significant infrastructure investments over the coming decades.

This provides a helpful jumping-off point for thinking about the economics of the sector, and why it’s worth at least considering.

Nuclear Fission Market Map

The market map focuses on the deep tech fission space — which has serious overlap with, but is not necessarily identical to, the VC-backed fission space.

As a group, these companies are building what I think of as the cutting edge of commercial nuclear products in the western world.

Key Verticals

One of my VC media peeves is not being able to find the logos referenced on market maps, so here are the links to all the companies’ landing pages.

Supply Chain

Companies in this part of the market map may run reactors. But what makes them interesting is that they play a role in the nuclear fuel supply chain as well. Part of that is likely vertical integration, but I’m also just intrigued by companies in this space working on multiple products at the same time.

Small Modular Reactors

Small Nuclear Reactors (SMRs) are a class of reactors with about a third the power output of more traditional reactors. They also as a rule have physically smaller dimensions, and are assembled and shipped for installation as a complete unit.

Molten Salt Reactors

These reactors use as their coolant a molten salt with a fissile material (instead of water, which is more common in the US). This concept is considered more safe than a water-cooled reactor, because both hydrogen explosions (Fukushima incident) and meltdowns (Three Mile Island incident) are impossible by design.

Thorium Reactors

These startups are developing reactors which use Uranium processed from Thorium. There are significant engineering tradeoffs as a consequence of this design decision.

New Commercial Products

These startups sell products that used to not be manufactured using nuclear reactors.

This is the part of the fission market that I’m most excited about.

Supply chain is critical, but well-defined. It’s also particularly tough to switch vendors in the middle of a project like this.

The three reactor categories are really driven by engineering differences, which determine their suitability for different use cases.

Commercial products are fascinating to me because they treat abundant energy with nuclear as the baseline, and then let the imagination run wild. As newer sources of nuclear power prepare to come online, I anticipate a lot of potential to use fission, and the nuclear energy fuel cycle more broadly, to solve related problems and create value for businesses and consumers.

I’m very excited to see what founders are working on in this space.

What’s missing here?

Software.

I’m still working through the role I see software playing in next-generation commercial nuclear activities.