Humanoid Robots Market Map & Investor List

Looking at the landscape of startups and investors

One of the trends accelerated by research into AI is the appearance of humanoid robots in real life.

Humanoid robots are interesting to me because they remind me so much of convergent evolution. Some of these startups are spun out of robotics labs, and others are founded by AI engineers. They often look quite similar — and have similar initial use cases.

At the same time, the breadth of applications for this technology is stunning. Startups are applying humanoid locomotion techniques to work on everything from logistics to medical rehabilitation, and beyond.

Startup Map

This map shows the venture-backed startups, and selected other companies, that I’m tracking as either solving the problems most critical to humanoid robot maturation, or piloting using humanoid robots in the most commercially interesting ways.

Key Verticals

Here are links to all the startups in the market map.

True Humanoids

Partial Humanoids

These startups are creating robots with some human characteristics, and some distinctly non-humanoid characteristics — like wheels, or sitting on a baseplate.

I initially thought this might be the busiest part of the market. It wound up being sparsely populated because it is an edge case; most robots were either clearly humanoid, or so clearly non-humanoid as to not warrant including.

Robotic Exoskeletons

Robotic exoskeletons are a technically differentiated approach to robots that articulate a human-like range of motion. Most exoskeletons in use today have the wearer as the primary payload.

Software

There’s a real question as to what makes a robotics startup a software startup. As I put the market map together, the key differentiator I sought out was the extent to which the startups seemed to feel that their value proposition relied on using their specific hardware.

Investors

This is a list of financial and institutional investors in the startups above (according to PitchBook) that express interest in robotics-related technologies. Firms that invest at multiple stages are shown at the first stage where they’ve invested in the field. Within each stage, they are in alphabetical order.

Seed

Series A

Series B

Trends

PitchBook didn’t label any humanoid robotics company’s first raise as a pre-seed round. My best guess is that this happened because the pre-seed role in this part of the ecosystem is filled by accelerators and university labs.

The largest set of new investors here entered at Series A. This suggests that funds which invest earlier tend to be more specialized.

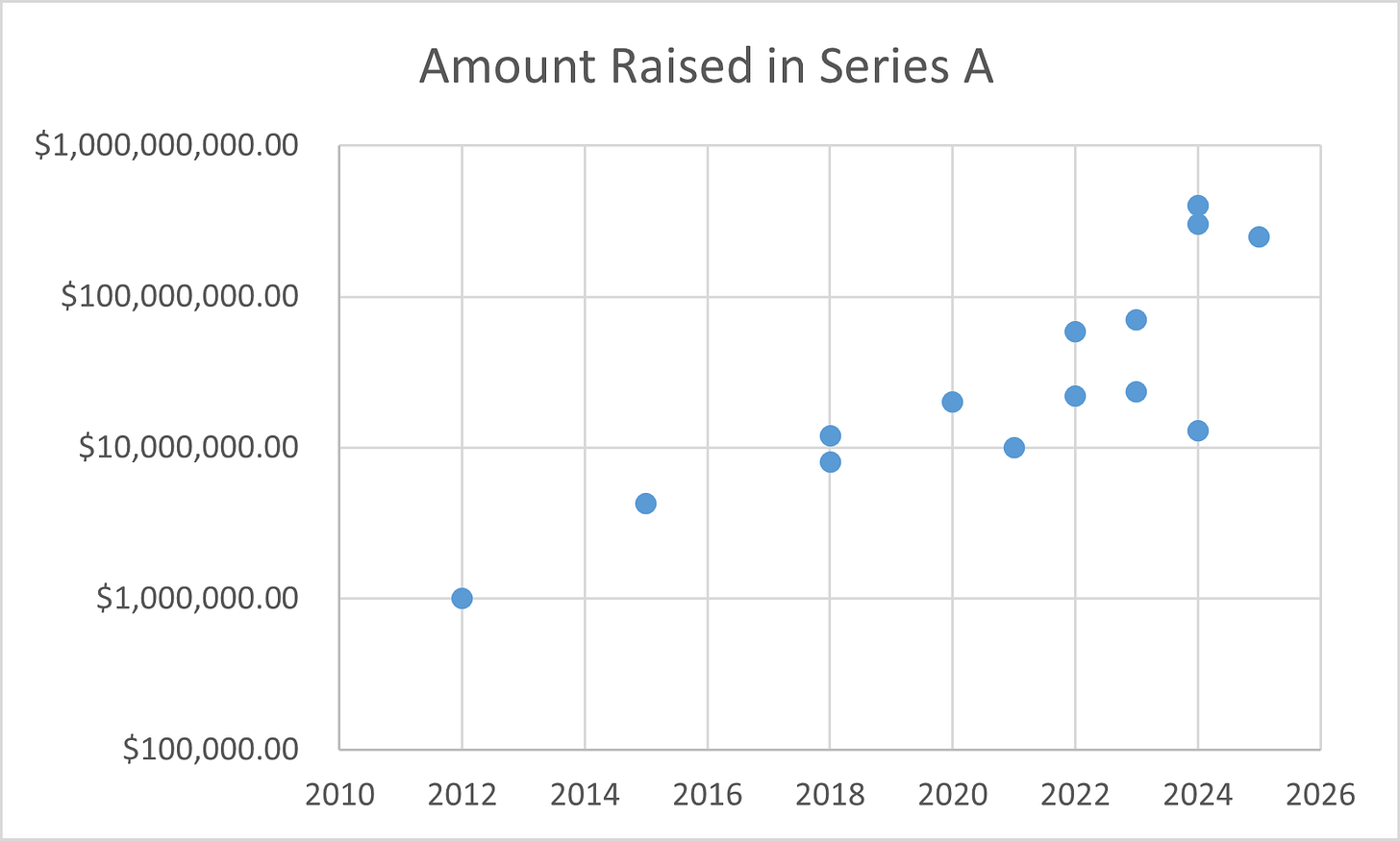

However, the size and valuation of Series A rounds varied wildly — so much so that the y-axis in the plot below needed a logarithmic scale.

I think there’s three reasons for this:

There’s a trend of financing rounds at the same stage to get more expensive over time, for several reasons. That gets at the issue of why Seed stage funds exist.

The AI hype cycle increased the price of equity in the many robotics companies that are using AI.

Founders generally delay raising VC rounds for as long as possible. This is rational because R&D cycles for hardware and AI are long, and venture capital is both expensive and starts a clock of sorts. Robot startups can often raise some capital without revenue. Because these round dynamics are at least in part a function of technical risk, and the risks specifically in AI appear lower now, equity in these startups commands a higher price than it used to.